Asia, known for its rich cultural diversity, thriving economies, and vast population has been instrumental in providing a fertile environment for MLM companies aiming to extend their global footprint. Within this context, Asian business interests converge with entrepreneurial endeavors, cross-border investments, and strategic partnerships, further fueling the proliferation of MLM ventures in the region.

As traditional boundaries begin to blur, and connectivity becomes more pervasive, Asian direct selling companies have undergone a parallel transformation by leveraging the inherent power of ever-changing consumer behaviors. Asia has also emerged as a focal point for innovative direct selling trends that mirror the region's progressive spirit and adaptability.

List of Top MLM Companies in Asia

The following table highlights the top Asian direct sales companies, which not only hold a prominent position on the global rank list of multi-level marketing companies but also showcase a diverse range of revenue streams and sectors that are currently receiving significant consideration.

| # | Company | Country | Revenue 2024 (in million USD) |

Revenue 2023 (in million USD) |

Growth Rate | Products & Service | Year Founded |

|---|---|---|---|---|---|---|---|

| 1 | Coway | South Korea | 3,031 | 2,699 | 12% |

|

1989 |

| 1 | Infinitus | China | 3,000 | 3,500 | -14% |

|

1992 |

| 3 | Atomy | South Korea | 1,830 | 1,710 | 7% |

|

2009 |

| 4 | JoyMain Int. | China | 1,300 | 1,300 | 0% |

|

2000 |

| 5 | Perfect China | China | 1,200 | 1,250 | -4% |

|

1994 |

| 6 | Sunhope China | China | 1,100 | 1,200 | -8% |

|

1993 |

| 7 | New Era Health | China | 1,000 | 1,000 | 0% |

|

1995 |

| 8 | Longrich | China | 850 | 850 | 0% |

|

1986 |

| 9 | Quanjian | China | 650 | 650 | 0% |

|

2004 |

| 10 | Amore Pacific | South Korea | 585 | 585 | 0% |

|

1945 |

| 11 | RIMAN | South Korea | 545 | 545 | 0% |

|

2018 |

| 12 | QNet | Malaysia | 520 | 520 | 0% |

|

1998 |

| 13 | Golden Days China | China | 446 | 446 | 0% |

|

1991 |

| 14 | Tiens | China | 435 | 435 | 0% |

|

1995 |

| 15 | Farmasi | Turkey | 429 | 440 | -3% |

|

2003 |

| 16 | Pola | Japan | 411 | 433 | -5% |

|

1929 |

| 17 | Miki Corp. | Japan | 358 | 371 | -4% |

|

1965 |

| 18 | Cosway | Malaysia | 350 | 350 | 0% |

|

1979 |

| 19 | ModiCare | India | 350 | 350 | 0% |

|

1996 |

| 20 | LG Household & Health | South Korea | 320 | 320 | 0% |

|

1947 |

| 21 | For Days Co. | Japan | 301 | 301 | 0% |

|

1997 |

| 22 | Betterway | Thailand | 280 | 280 | 0% |

|

1988 |

| 23 | Noevir | Japan | 245 | 245 | 0% |

|

1964 |

| 24 | Alliance In Motion | Philippines | 238 | 238 | 0% |

|

2005 |

| 25 | Best World International | Singapore | 235 | 228 | 3% |

|

1990 |

| 26 | Naturally Plus | Japan | 208 | 218 | -5% |

|

1999 |

| 27 | Anran | China | 210 | 210 | 0% |

|

2005 |

| 28 | Kangmei | China | 210 | 210 | 0% |

|

1997 |

| 29 | Elken | Malaysia | 200 | 200 | 0% |

|

1995 |

| 30 | Ten Lead BioTech | Taiwan | 200 | 200 | 0% |

|

N/A |

| 31 | Alphay International | China | 195 | 195 | 0% |

|

2002 |

| 32 | Gano Excel | Malaysia | 178 | 178 | 0% |

|

1995 |

| 33 | BearCere Ju | Japan | 163 | 165 | -1% |

|

1992 |

| 34 | JapanLife Co. | Japan | 158 | 158 | 0% |

|

1975 |

| 35 | Vestige Marketing | India | 154 | 154 | 0% |

|

2004 |

| 36 | Giffarine | Thailand | 152 | 150 | 1% |

|

1996 |

| 37 | PhytoScience | Malaysia | 150 | 150 | 0% |

|

2012 |

| 38 | For You | China | 147 | 147 | 0% |

|

2012 |

| 39 | Menard Cosmetics | Japan | 129 | 150 | -14% |

|

1959 |

| 40 | Naris Cosmetics | Japan | 127 | 127 | 0% |

|

1932 |

| 41 | MI Lifestyle | India | 126 | 126 | 0% |

|

2013 |

| 42 | Assuran | Japan | 123 | 127 | -3% |

|

1994 |

| 43 | Kangzen | Thailand | 110 | 110 | 0% |

|

1993 |

| 44 | Zhulian Marketing | Malaysia | 108 | 108 | 0% |

|

1989 |

| 45 | Maruko | Japan | 106 | 121 | -12% |

|

1964 |

| 46 | The Maira Co. | Japan | 105 | 105 | 0% |

|

1991 |

| 47 | Diana Co. | Japan | 104 | 105 | -1% |

|

1986 |

| 48 | RCM Marketing | India | 101 | 101 | 0% |

|

2001 |

| 49 | Crowd1 | UAE | N/A | N/A | N/A |

|

2019 |

| 31 | Earn World | Singapore | N/A | N/A | N/A |

|

N/A |

©

Epixel MLM Software

Data updated in August 2025

Source - businessforhome.org

*The above list is subject to market changes and modifications.

Delve deeper into the ways in which the leading 100 MLM companies contribute to molding the global direct selling arena.

As we draw conclusions from the table, it’s evident that Coway holds the position of Asia's no. 1 company in direct selling. Ever since its establishment in 1989, Coway has experienced significant growth and prevalence in the Asian market over the past few decades.

The factors contributing to the growth of MLM companies in Asia have been substantial and that includes increasing urbanization, disposable incomes, and the use of advanced technologies.

Due to the presence of a diverse and dynamic market, MLM companies have been able to build extensive networks of distributors and customers, tapping into a vast potential customer base. Moreover, Asian citizens view network marketing to fulfill their entrepreneurial aspirations, enhance personal connections, and achieve financial independence.

Despite the geographical barriers, vibrant MLM markets have secured their place in the countries like China, Japan, and Malaysia. Take Coway, for example, which has solidified itself as a leader in the Asian network marketing market for top-tier purifiers since its inception in 1989 and is still instrumental by achieving substantial revenues of $3.03 billion 2024 and $2.9 billion in 2023 respectively. Furthermore, network marketing companies such as Atomy, established in 2009, have become global contenders in cosmetics by attaining a high hit record of $1.83 billion in the year 2024. This exemplifies the ongoing impact of MLM companies as they continue to contribute to entrepreneurial opportunities that make direct selling a popular choice in the gig economy marketplace.

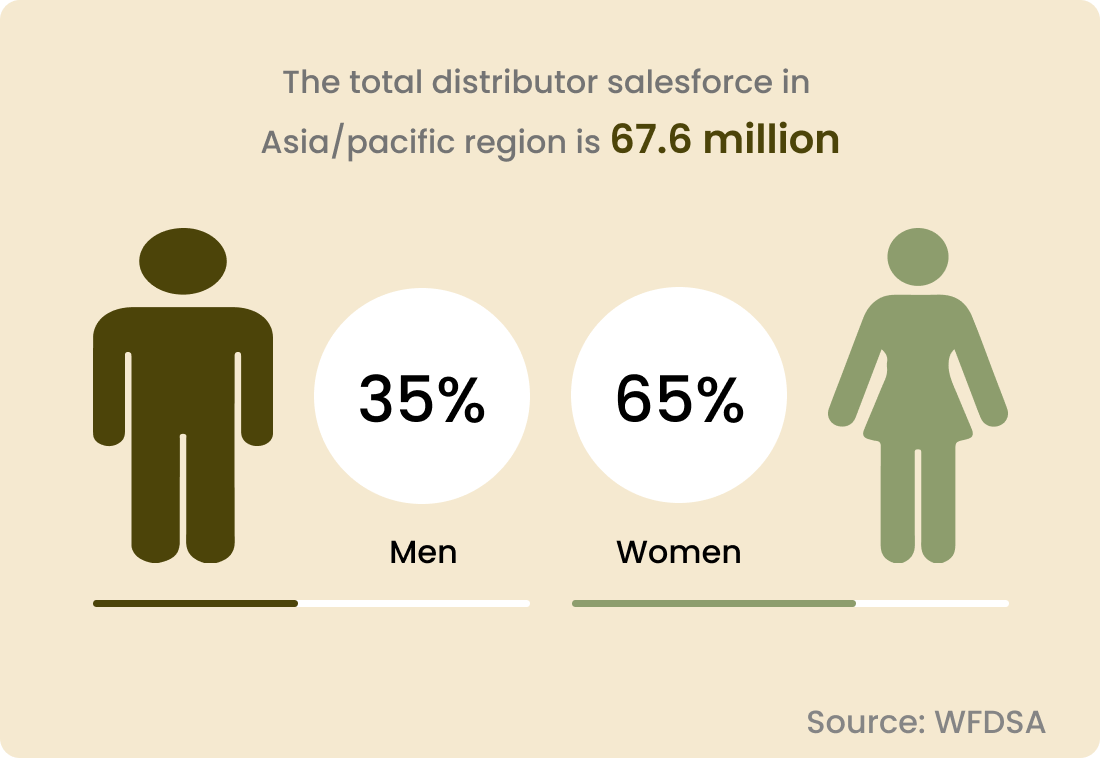

Throughout Asian societies, the value of building brand credibility and fostering trustworthiness has been deeply ingrained. Consequently, the direct selling model has prioritized empowering its distributors with comprehensive training, valuable mentorship, and opportunities for leadership development. This approach resonates harmoniously with the growing emphasis on gender equality and empowerment of women in the region.

Top 10 direct selling companies in Asia 2025

COWAY

COWAY

Country: South Korea

Website: www.cowayir.co.kr

Top Earners: N/A

Products & Services: Household appliances, Air purifiers

Founder: Yoon Seok-keum

CEO: Seo Jang-won

Year Founded: 1989

Headquarters: Gongju, South Korea

Achievements:

- Ranked #8 in 2025 DSN Global 100.

- Recipient of Red Dot Design Award.

- Recipient of IF Design Award, and the IDEA (International Design Excellence Award).

Infinitus

Infinitus

Country: China

Website: www.infinitus-int.com

Top Earners: N/A

Products & Services: Health Products

Founder: Lee Kum Kee Group

CEO: Lam Yu

Year Founded: 1992

Headquarters: Guangzhou, China

Achievements:

- Awarded National Green Factory Status.

- Recognized as One of the Top Employers of China 2024.

- Awardee of 2023 National Business Quality Award.

Atomy

Atomy

Country: South Korea

Website: https://global.atomy.com/

Top Earners: N/A

Products & Services: Health and wellness, Beauty

Founder: Han-Gill Park

CEO: Han-Gill Park

Year Founded: 2009

Headquarters: Gongju-si, Chungcheongnam-do, Republic of Korea

Achievements:

- Ranked #10 in 2025 DSN Global 100.

- Received the Minister of Commerce, Industry and Energy Award for ESG Report.

JoyMain Int.

JoyMain Int.

Country: China

Website: www.jmtop.com

Top Earners: N/A

Products & Services: Nutrition & health care

Founder: N/A

CEO: Xu Zhiwei

Year Founded: 2000

Headquarters: Shanghai, China

Achievements:

- China's Top Ten Credible Brands for Healthcare Products.

- China's 500 Most Valuable Brands.

Perfect China

Perfect China

Country: China

Website: www.perfect100.com/

Top Earners: N/A

Products & Services: Health care, Skin care, and Personal care

Founder: N/A

CEO: Koo Yuen Kim

Year Founded: 1994

Headquarters: Zhongshan City, Guangdong, China

Achievements:

- Top 100 Star Overseas Enterprise.

Sunhope

Sunhope

Country: China

Website: www.sunhope.cn

Top Earners: N/A

Products & Services: Nutritious foods, skincare, home care

Founder: Kazuyuki Masumitsu

CEO: Shangji hen

Year Founded: 1993

Headquarters: Beijing, China

Achievements:

- Perfect Enterprise of the year 2022.

- Won Charity Driving Award of 2021.

- Awarded the Health Industry Social Responsibility Star of 2021 by Finance China.

New Era Health

New Era Health

Country: China

Website: www.intgz.com/en

Top Earners: N/A

Products & Services: Health care, nutritious foods

Founder: N/A

CEO: N/A

Year Founded: 1995

Headquarters: Houston, Texas, USA

Achievements: N/A

Longrich

Longrich

Country: China

Website: www.longrichbioscience.com

Top Earners: N/A

Products & Services: Health care

Founder: Xu Zhiwei

CEO: Xu Zhiwei

Year Founded: 1986

Headquarters: Jiangsu, China

Achievements:

- Top 100 Growth Brand in Asia 2015.

- GSK award for best supplier 2014.

Quanjian

Quanjian

Country: China

Website: en.ziranyixue.com

Top Earners: N/A

Products & Services: Health care

Founder: Shu Yuhui

CEO: Shu Yu Hui

Year Founded: 2004

Headquarters: Tianjin, China

Achievements: N/A

Amore Pacific

Amore Pacific

Country: South Korea

Website: www.amorepacific.com/

Top Earners: N/A

Products & Services: Skincare, Makeup, and Fragrance

Founder: Suh Sung-whan

CEO: Suh Sung-whan

Year Founded: 1945

Headquarters: Seoul, South Korea

Achievements:

- Receives the CES Innovation Award 2023 for fifth consecutive year.

- Secures Three '2024 Good Design Awards' for Outstanding Designs.

Discover how we build resilient businesses with advanced MLM functionalities

Insights on MLM companies in Asia

To align with the expanding population of tech-savvy consumers in Asia, MLM companies have harnessed the power of digitalization and ecommerce. Today, online platforms, social media, and mobile applications have become integral tools for MLM businesses, facilitating product promotion, engaging with potential distributors, and proficiently managing their networks.

Direct selling industry in Asia

The direct selling industry in Asia experienced a notable transformation in its year over year performance. According to the World Federation of Direct Selling Association (WFDSA) 2020-2023 reports.

Moreover, WFDSA 2023 report states that, in 2023, the global direct sales market was led by the countries in Asia/Pacific region that generated $67.57 billion, contributing 40.3% of total revenue. Among those countries, Korea, China and Japan played a crucial role in navigating the dominance of the region by being the highest contributors in direct selling. The contribution was led by Korea with an annual revenue of $16.3 billion, followed by China ($15.04 billion) and Japan ($10.63 billion). This evolution underscores the region's pivotal role in shaping the future of the direct selling industry on a global scale.

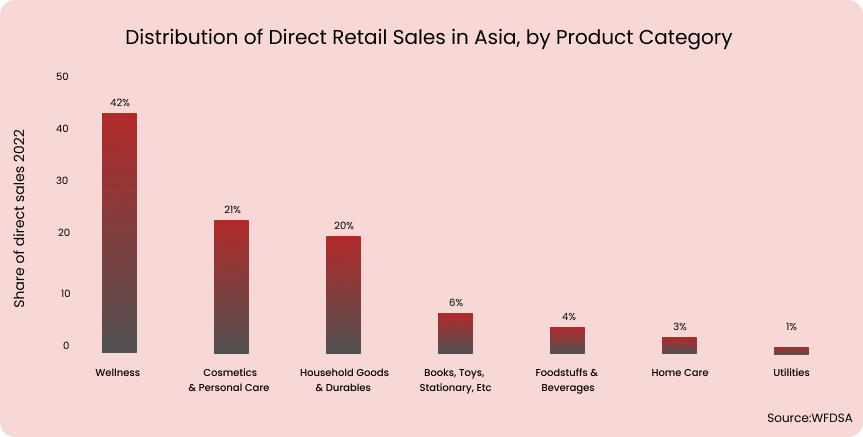

Covering numerous countries and encompassing diverse economic environments, Asia’s top direct selling companies offer an exciting and thrilling experience for their customer base. These businesses have leveraged the region's robust social networks, offering a spectrum of products such as health and wellness (39%), cosmetics and personal care (17%) and household goods (25%). This strategic approach has contributed to the growth of their customer outreach.

Disclaimer: Epixel neither promotes nor supports any of the companies mentioned in this article nor their products or services. The facts published here are represented as reported in the direct selling industry. The facts don't reflect our priorities. The article was compiled based on available resources and does not represent special mentions or priorities to organizations, persons, or products.

Enterprise MLM Growth Platform

Dynamic Commission Engine

Ensure flexibility, accuracy and transparency

Scalable Infrastructure

Architecture that can handle millions of distributors & & transactions

International Expansion

Multilingual, multi-currency, global compliance & tax ready

Leave your comment

Fill up and remark your valuable comment.