In this article

Businesses rely on data to build their strategies because strategies build on intuitions and assumptions only fail. The mathematics of success is based purely on statistics. Statistics reflect on the success and failure of strategies. Hence, it has the efficiency and authority to lead businesses in the right direction.

Statistics suggest that when customers complain, business owners and managers ought to get excited about it. The complaining customer represents a huge opportunity for more business. Zig Ziglar

Direct selling industry has, over the generations, been through many highs and lows and each point in the graph has a different story to tell—a story of successful strategies, poor adoptions, and neglected insights.

The 100+ MLM stats and insights listed here deliver deeper insights into the potential of MLM as a direct sales channel. The stats have been curated into different categories such as company, distributor, product, consumer, and entrepreneur to assist you in quicker navigation.

The industry research and development team at EpixelEpixel MLM Software provides technology solutions to help MLM and direct selling companies to digitally transform into a customer-centric organization. has curated the popular MLM statistics and network marketing facts to help you get a better understanding of the MLM industry.

MLM Regional Stats & Insights

Let's see which all countries top the MLM sector worldwide and how much sales and revenue they pull in each year.

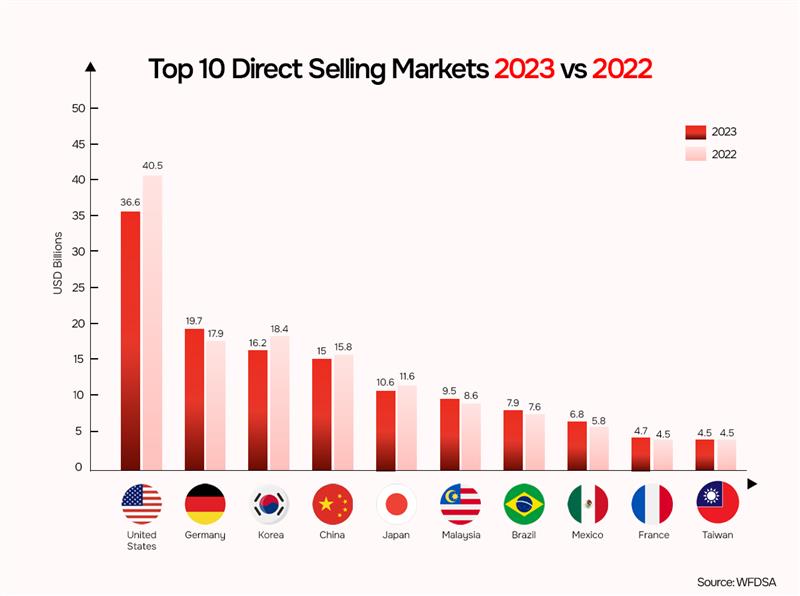

- In 2023, the direct selling industry made $167.6 billion USD in retail sales.

- Total global direct sales dropped 2.3% year-over-year.

- 47 out of the 70 global markets reported positive retail sales growth.

- The largest ten markets accounted for 78% of global sales of the network marketing industry.

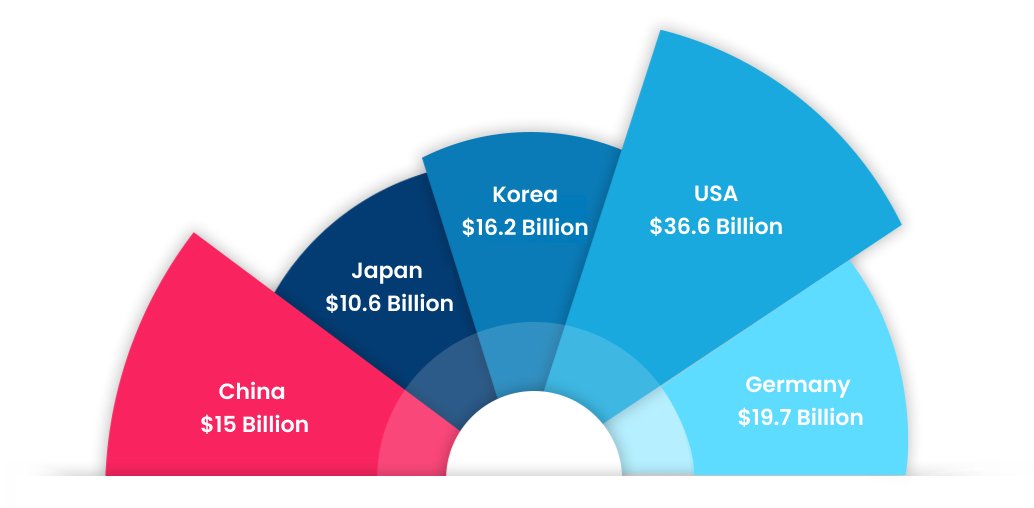

- USA contributed 22% of the global sales, followed by Germany (12%), and Korea (10%).

- USA becomes the global leader in retail sales with annual sales of $36.6 billion.

- Compared with a decade ago, there is an increase of 40% in the retail sales of US.

- Germany stands second with total retail sales of $19.7 billion.

- Korea takes the third position with $16.2 billion retails sales.

- China and Japan hold 4th and 5th positions with $15 billion and $10.6 billion respectively.

- They are followed by Malaysia(9.5B), Brazil(7.9B), Mexico(6.8B), France(4.7B), and Taiwan(4.5B).

- Germany(7%) achieved positive sales growth in constant 2023.

- USA, Korea and Japan showed negative sales growth in 2023, -9.5%, -10.8% and -2.2%.

- Argentina marked the highest year-over-year percentage growth of 114.5% in 2023.

Global retail sales distribution in the direct sales industry in 2023

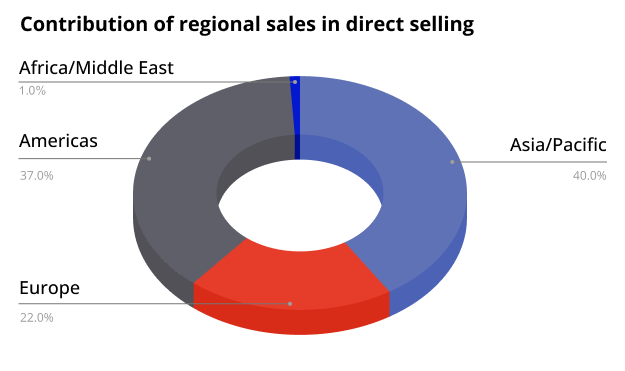

- Even with a –3.7% sales decline, Asia Pacific recorded $67,573 million in global retail sales, winning a market share of 40.3%.

- The Americas held the second largest market share at 37.3% with retail sales of $62,632 million. This fast-growing direct sales market, however, saw a sales decline of –3.8%.

- The global retail sales figure of Europe stood at $36,149 million with a market share pointing to 21.6%, 3.4% increase in growth compared to 2022.

- Africa and the Middle East together accumulated global retail sales of $1,340 million with a market share of just 8% after experiencing a decline of –4% in their sales growth rate compared to the previous year.

Performance of global markets from 2019-2023

Comparing the growth of these markets over a five-year period from 2019-2023 we see that

- Europe ranks as the best performing region with +8.6% total growth.

- Americas experienced a shimmering growth rate of +6.8%.

- While Asia Pacific dropped to –7.2%.

- Africa and the Middle East also had a drastic decline of –22.5% in the same period.

Global market penetration – Direct selling 2023

Direct selling industry made a high impact with global markets leading the charge. The recent WFDSA 2023 report lists the global direct selling markets based on their market penetration rate.

The high penetration markets include Malaysia, Korea, Peru, Bolivia, and Ecuador. The United States, Slovakia, Estonia and Italy were categorized as mid penetration markets and Switzerland, New Zealand, United Kingdom and Australia comprises the lower penetration markets.

The table below lists the penetration percentages of the above global direct selling markets.

| Direct selling global market penetration 2023 | ||

|---|---|---|

| Market | Level | Percentage |

| Malaysia | High | 2.286% |

| Korea | High | 0.952% |

| Peru | High | 0.796% |

| Bolivia | High | 0.760% |

| Ecuador | High | 0.752% |

| United States | Medium | 0.134% |

| Slovakia | Medium | 0.134% |

| Estonia | Medium | 0.134% |

| Italy | Medium | 0.131% |

| Switzerland | Low | 0.049% |

| New Zealand | Low | 0.047% |

| Australia | Low | 0.043% |

| United Kingdom | Low | 0.034% |

Key insights and observations on the global direct sales markets

Dominance of Asia Pacific and Americas

- Asia Pacific emerged as the leader in the global direct sales market with the highest retail sales and market share (40%). However, increasing market saturation and emerging business challenges forced a decline of 3.7% in 2023 and 7.2% since 2019.

- The second largest market share holder is the Americas. They suffered a decline of 3.8% in 2023 but over a five-year period from 2019-2023 it exhibited a consistent growth rate of 6.8%.

Europe’s steadfast growth

- Since 2019, Europe has demonstrated growth rate of +8.6% and +3.4% in 2023 alone.

- The success of Europe could be attributed to the favorable economic conditions prevalent in the region and the innovative direct selling techniques adopted by the contributors in the European direct sales industry.

Growth challenges in Africa and the Middle East

- The Africa and Middle East regions could only hold a market share of just 0.8%.

- Africa and the Middle East direct sales markets have also seen significant declines in 2023 (-4%) and over the five-year period from 2019-2023 (-22.5%).

- The declining sales figures are indicative of the many challenges the regions are facing including economic instability, regulatory hurdles or low consumer adoption of direct selling.

The sharp increases of Asia Pacific and Americas and steep declines in growth rates of Africa and Middle East along with Europe’s growth exhibits a shifting balance and emerging regional strengths within the global direct sales industry.

Strategic insights for direct selling businesses – The 2023 trends

1. Identify growth opportunities in high-growth regions

Europe is an emerging leader in the global direct sales market. Direct selling companies can invest in the potential of the region by identifying niche markets, understanding customer cohorts and devising ideal marketing strategies to capture the growing international markets within Europe.

2. Focus on overcoming challenges in the declining markets

Despite being leaders, Asia Pacific and Americas are seeing a decline. The cause of the decline may vary from market to market and company to company. It could either be market saturation, rising competition or changing customer preferences. The direct selling companies in these regions must investigate the underlying causes for concern and develop new solutions to counter the effect.

3. Tap into the potential of untapped markets

Africa and the Middle East have relatively low penetration rates and have suffered a decline in sales growth over the years. The capacity of these untapped markets may be mastered through a well-structured approach considering the local market demands, cultural nuances and regulatory environments. Building brand awareness and trust through strategies that resonate with the local crowd may also be important.

4. Diversification and risk management

The unpredictable market conditions are always a threat to businesses. Reduce dependency on a single market and diversify your presence into multiple markets of varying potential. This will help reduce associated market risks and maintain stability in business growth and revenue.

5. Stay close to economic trends

Regularly monitor key economic indicators such as GDP growth, unemployment rates, disposable income levels, consumer spending and inflation to understand opportunities and threats in the regional markets. This way you can create tailored offerings to meet regional demands effectively.

Asia/Pacific regional overview

Retail sales trends in Asia Pacific: A 2023 overview

Sales growth excluding China

- The retail sales growth in the region increased by 6.3% from $49,428 million in 2019 to $52,530 million in 2023.

- The annual growth of Asia Pacific from 2020 to 2023 were as presented below:

- 2020 saw 3.9% growth with $51,337 million.

- 2021 recorded a 2.2% increase amounting to $52,465 million.

- 2022 experienced a 5% spike recording $55,097 million.

- 2023 suffered a decline of 4.7% with $52,530 million.

China’s retail sales performance

- The period from 2019-2022 was marked by a constant decline with no growth recorded.

- The year-wise retail sales data is outlined below.

- 2020 faced a decline of –20% with $18,687 million.

- 2021 improved a bit marking a decline of only –13% with $16,351 million.

- 2022 reported an 8% decline with $15,043 million.

- In 2023 the sales fell flat due to the stabilization caused by the Zero COVID policy and other regional disruptions.

Country-specific insights on the leading Asia Pacific direct sales markets

Hong Kong

Hong Kong faced a retail sales decline of 11% generating just $355 million in 2023.

Market trends in Hong Kong direct sales

- Direct sales customers in Hong Kong prefer shopping online for convenience and to explore trending products.

- The spending trends in Hong Kong is influenced by its soft economy with consumers purchasing fewer and lesser expensive items.

Direct sellers in Hong Kong

- The member preferred customers decreased from 95,000 in 2022 to 83,000 in 2023.

- The number of independent representatives saw a slight decline of just 1% recording 233,000 in 2023.

- However, there was an 8% increase in the number of active representatives which totaled 90,000 in 2023.

Insights for direct selling companies

- Attract younger generations with marketing strategies that reflect their interests.

- Build a value-based business prioritizing environmental, social and governance (ESG) principles.

- Highlight growth opportunities beyond income like personal development and community benefits.

Korea

The retail sales trends in Korea over the period from 2019-2022 indicate a 15.8% growth from $15,783 million in 2019 to $18,274 million in 2022. The decline in 2023 came as a surprise to the Korean direct selling industry when the retail sales fell at 10.8% recording $16,298 million. The reasons cited for the decline include decreased household consumption and disposable income influenced by higher interest rates.

Direct sellers in Korea

- An analysis into the demographics of Korean direct sellers reveals that the salesforce is aging citing a rising need to engage and attract the younger generations.

- Women direct sellers in Korea constitute 79% of the total salesforce in the country.

- Among Korean sole proprietorships, however, women represent only 47% of the total direct sellers.

Entrepreneurial interest among Koreans

- 38% of Koreans prefer direct selling for the opportunities it holds for individuals to start business.

- 55% of Koreans in direct selling enjoy the social engagement aspect of the model.

Insights for direct selling companies

- Targeting younger demographics with attractive compensations and appealing marketing strategies can help create a diverse seller base.

- Focus on supporting and empowering the women base with tools and training sessions to strengthen their presence and improve their productivity.

- Create brand communities to engage direct sellers who enjoy social engagement that cultivate a sense of belonging and shared experiences.

Taiwan

Taiwan experienced a growth rate of 23% and has a recorded sales figure of $4530 million. Taiwan is also being positive about 2024 with 46% of direct selling companies expecting an improvement in their revenue growth. The projections for 2024 also hold some tension with 40% of companies forecasting flat sales and another 14% fearing a decline.

Market trends in Taiwan direct sales

- Taiwanese value personal interactions and lay strong emphasis on maintaining the same in businesses and personal life.

- The changing consumer preferences in Taiwan has brought social selling and ecommerce to the spotlight which reduces person-to-person contact.

- Social media influencers pose fierce competition for direct sellers, but stable income opportunities and low entry barriers strengthen direct selling as a reliable business model.

Direct sellers in Taiwan

- 72% of direct sellers in Taiwan are women.

- Only 37% of women have opted for sole proprietorship.

Insights for direct selling companies

- Implement social media strategies like influencer partnerships and social selling techniques to attract younger Taiwanese.

- Empower young entrepreneurs with relevant training programs and transparent business plans to build confidence and trust.

Thailand

Retail sales declined by 6% in 2023 generating $2161 million.

Market trends in Thailand direct sales

- The Thai market is witnessing a growing demand for wellness products and leading direct selling companies are reinforcing their wellness product line.

- Younger generations in Thailand are interested in and looking for independent business opportunities.

- The technological expertise of direct sellers in Thailand is comparatively sound and are keener on adopting online platforms for sales.

- Online content creators and gig work platforms pose competition to direct selling. Personalized product recommendations and personal interactions are driving the model in the Thai market.

Insights for direct selling companies

- Focus on wellness products and identify trending products among consumers.

- Develop online tools and virtual training or brand programs to keep the Thai direct seller base engaged and productive.

- Create promising business opportunities and stronger customer relationships to overcome the competition.

| Performance of the top 10 Asia Pacific markets | |

|---|---|

| Country | Annual retail sales change (%) |

| Korea | -10.8% |

| China | 0% |

| Japan | -2.2% |

| Malaysia | +1.4% |

| Taiwan | +3.3% |

| India | +11.8% |

| Thailand | -6% |

| Indonesia | -10.6% |

| Philippines | -14.9% |

| Vietnam | -19% |

Growth rate analysis of the top performing Asia Pacific direct sales markets

- India, Taiwan and Malaysia have exhibited a growth rate in 2023 possibly due to favorable market conditions and impressive direct selling strategies.

- China remained constant with no growth or decline.

- The decline in retail sales in Korea, Japan, Thailand, Indonesia, Philippines and Vietnam could indicate the wavering market conditions, changing customer preferences and regional regulatory challenges.

- India leads the Asia Pacific with 11.8% growth rate.

- Philippines suffered a severe decline of –14.9%.

Key insights for direct selling companies

- India, Taiwan and Malaysia remain a stable ground for direct selling. Companies can take advantage of these growing markets to build new networks.

- Direct selling operating in declining markets must invent new strategies or targeted approaches to recapture the markets and improve the growth rates. Invest in online sales capabilities and diversify product offerings to ensure success in these markets.

Strategic recommendations for the Asia Pacific direct selling industry

- Follow digital transformation trends: Implement advanced ecommerce and maximize the use of social media platforms to keep pace with the market and its customers. Adopt virtual and online training tools to upskill direct selling representatives.

- Focus on product innovation: Identify products that match the cultural and regional preferences. Diversify and innovate your product line, especially health and wellness products, to establish successfully in the niche markets.

- Attract younger generations: Create appealing marketing and compensation strategies that interest younger generations to join the industry. Enhance the productivity of your younger salesforce teams with the right tools and relevant training sessions.

- Integrate ESG into core business strategies: Build value-based customer relationships and attract socially responsible representatives with economic, social and governmental principles in your direct selling business.

- Localize business strategies: Promote localization across your marketing, product manufacturing and customer-related processes. Team up with local entities to strengthen market presence and avoid the risk of non-compliance with the local regulations.

- Empower your female entrepreneurs: Motivate the women direct sellers with support and success stories of their close counterparts. Provide them with the guidance and training needed to excel in the field.

Europe regional overview

Retail sales trends in Europe: 2023 overview

Europe has exhibited remarkable growth in direct selling over the past few years. Analyzing a four-year growth period from 2019-2023 we derive the following insights:

- The 2019-2023 period in Europe saw an overall growth rate of 8.6%.

- In 2020, retail sales grew by 1.6% to reach $33,824 million despite the impact caused by the pandemic.

- 2021 witnessed 4.4% growth with retail sales recorded at $35,298 million.

- Across the four-year period, only 2022 saw a decline of 1.0% marking $34,958 million in retail sales.

- The 2023 retail sales report comes as a relief with a 3.4% growth increase amounting to $36,149 million.

Top European direct sales markets 2023

Europe claims 6 out of the 24 billion dollar direct sales markets. Here’s a snapshot into the performances of the top European markets:

- Germany ranks #2 among the global billion dollar markets with 5.1% growth rate.

- France stands at #9 in the global billion dollar market list with a decline in growth rate of –1%.

- Italy has a growth rate of 3.3% and is at #12 in the list.

- Russia even with a decline rate of –1.7% held its position at #19 among the global billion dollar markets.

- United Kingdom ranked at #20 had recorded a growth rate of 3.4%.

- Poland at #21 also has a growth potential for direct selling as a business model. The European country in 2023 showcased a growth rate of 1%.

Country-specfic insights on the European direct selling markets

Germany

Germany is one of the largest European direct sales markets and accounts for 54.7% of retail sales in the continent. The sales growth in 2023 increased by 7% and surpassed the overall retail growth of 2.9% and online retail sales of 1.3%.

Emerging direct sales categories in Germany

- Energy

- Telecommunication

Direct selling salesforce in Germany

The direct seller demographics of Germany cites 35% women and 38% women in the German sole proprietorship.

Entrepreneurial perceptions in Germany

- 36% of German adults consider it easy to start a business.

- 41% are positive about finding good business opportunities.

- 42% are confident about their skillset and knowledge to start a new business.

What does the future of direct selling in Germany look like?

- Direct Selling Association predicts sales growth and salesforce decline in 2024.

- Social media will influence most of organizational marketing, products and incentive structures to attract younger generations.

Russia

The Russian direct sales market had a decline in retail sales in 2023 by 7.3% and generated $1,266 million.

Challenges faced by the Russian direct selling market in 2023

- Lower consumer income reduced spendings negatively impacting the direct sales market.

- Rising competition from online sales channels made it difficult for companies with poor tech adoptions to mark even a slight growth rate.

Trends in Russia direct sales

- Russian direct sales market witnessed a growing demand for personalized communication, trust and loyalty in customer-brand relationships.

- Increasing interest of consumers were noted in Asian beauty products, devices and locally produced goods in the personal care, home care and wellness categories.

Direct seller demographics in Russia

- 70% of direct sellers under the age of 25 consider direct selling as a mainstream income.

- Women direct sellers in Russia constitutes 89% of the region’s direct selling workforce compared to 44% of new sole proprietors.

United Kingdom

Retail sales of the DSA members in the region suffered a decline by 10% in 2023.

What does the future of direct selling in the United Kingdom look like?

- The UK DSA is optimistic for 2024 with direct selling companies expected to adopt digital tools and strategies.

- The changing consumer preferences linked to purpose and values will find a place in the brands’ ESG strategies.

Trending product categories in the UK direct selling market

- Health and wellness

- Beauty and personal care

- Sustainable and eco-friendly products

- Technology and digital products

- Personalized products

Product innovations in the UK direct selling industry

The UK direct selling market saw interesting preferences among various customer segments.

- Personalized nutritional and wellness plans

- Hybrid product experiences like fitness equipment paired with virtual training programs

- Eco-packaging and refill solutions

- CBD and hemp-based products

- Wearable health devices

Direct sellers in the United Kingdom

- New sellers entering direct selling are more diverse, digitally sound focuses on personal development.

- Flexible and entrepreneurial opportunities together with increased usage of social media and ecommerce platforms fuel interests among the young direct sellers.

- Economic instability and downturns cause people to look for additional income opportunities.

Strategic insights for direct selling companies operating in Europe

- Younger people are interested in modern products and innovations.

- Most prefer direct selling for the community benefits such as events, online groups and mentorship programs.

- Gig economy, ecommerce platforms, subscription services and influencer marketing pose real competition for direct selling in the UK.

- Emphasizing relationship selling turns out to be a competitive advantage in the UK market.

- Low entry barriers are also an added plus point for the industry.

- Regions with weaker economies have forced consumers to purchase inexpensive items and reduce spending.

MLM Company Stats & Insights

Here are some interesting and useful insights and network marketing facts to help you with your journey in building a successful business.

- The first direct selling company established is Southwestern Company which started in 1855.

- Renamed later into Southwestern Advantage, they generated a revenue of $145 million in 2022.

- 21% of the top 100 direct selling companies recorded positive revenue growth rate.

- 58% of the top 100 MLM companies are US-based, followed by 9% in China.

- The top 3 network marketing companies based on 2023 revenue are Amway, Natura & Co and Herbalife.

- Amway has an annual revenue of 7.7 billion USD in 2023 and is holding the first position in top direct selling companies for the tenth consecutive year.

- The average income for all US Independent Business Owner (IBO) at Amway is $841 before expenses in 2023.

- 1 out 5 homes in the USA owns an Amway product.

- Amway employes more than over 1,000,000 business owners across 100+ countries and territories.

- Natura & Co made an annual revenue of $5.3 billion in 2023 and holds the second position in top earning direct selling companies.

- Natura & Co has about 6 million consultants and representatives as of 2023.

- 53% of the total workforce are in in leadership positions in Natura.

- The annual revenue of Herbalife went down 2% to $5.1 billion in 2023.

- Herbalife had approximately 6.5 million members in the markets, consisting of 3.5 million preferred members and 2 million distributors.

Some interesting stats about direct selling companies

- OmegaPro, founded in 2019, made a positive growth rate of 900% to make $250 million revenue in 2021.

- Revenue of eXp Realty’ become to make $4.3 billion in 2023.

- Optavia ranked first on Digital Momentum Index 2021 by DSN which ranks companies for their social media and online presence.

- Avon has a salesforce strength of more than 6,400,000 in USA.

- LifeVantage won the DSN Best Places to Work award for the 6th consecutive year.

- 8 direct selling companies achieved the DSN CCR Platinum Status - ACN, bhip Global, It Works, Le-Vel, Nu Skin, Scentsy, Pruvit, Usborne Books.

- 2 companies achieved the DSN CCR Gold Status in 2023 - MONAT GLOBAL, Perfectly Posh.

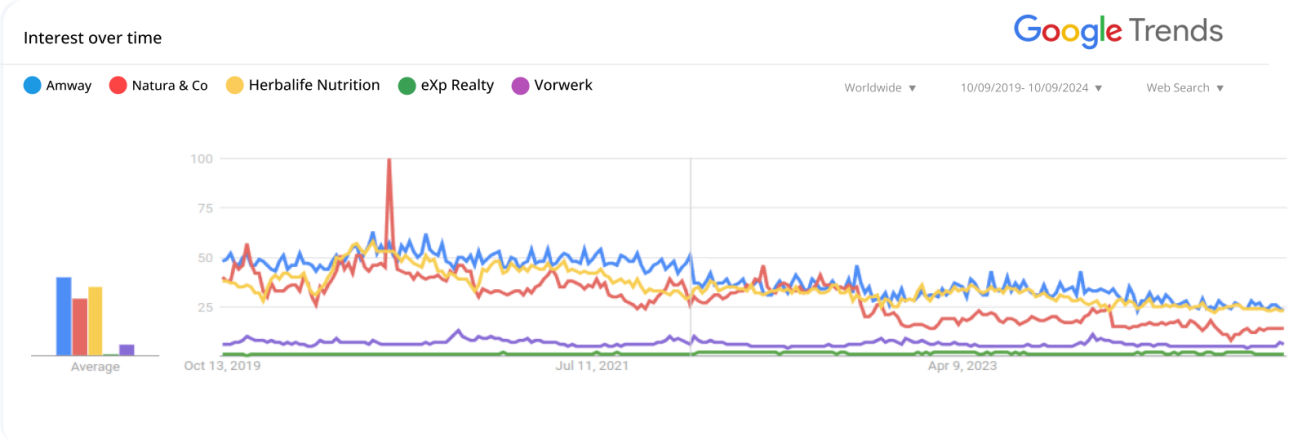

Web search trends of top MLM brands

Amway leads the top 100 MLM companies list in terms of sales revenue for the year 2020-2021, followed by Natura, Herbalife, Vorwerk, and Infinitus.

- Amway stays top in terms of web search trends among the five MLM companies with an average score of 40, followed by Herbalife with 35 , Natura & Co with 29, Vorwerk with 6, and eXp Realty with 1.

- The MLM company to achieve the maximum popularity score in 2023 is Amway.

- In the USA, the most popular multi-level marketing company among them is Amway with a score of 49, followed by Herbalife with 47, eXp Realty with 11, Natura & Co with 1.

Would You Like To See How A Startup Increases Sales Using A Direct Selling Strategy?

Graze | Snack manufacturers & their experiment in network marketing!

Case studies in network marketing prove to be an excellent way to improve your knowledge and skills in this area of expertise. Here, we’re providing you with one of the direct selling companies who integrated innovative ways to improve the business using this particular business model. Graze is a UK-headquartered food manufacturing/selling company who implemented a graceful marketing model.

About Graze and the famous graze boxes!

Launched into the world of yummy and healthy food manufacturing in 2009, the success rate of the “graze box” went up in no time. From the available resources and references, we have found out a count of about 80,000 boxes have been sold over a period of 6 months. Basically, they sell a box of nutritious snacks with various combinations with a view of making people love healthy food.

Their motive and business model was perfect and offered stable growth. Graze boxes were sold using both offline and online strategies, they kept pushing the limits using different marketing channels.

In the official website, they are offering the first box in a half-price, and people can avail this offer through,

- Email marketing.

- Direct/network marketing.

- Referral marketing.

- Social media marketing.

Yes, email marketing still exists in 2022, and it’s a broadway to reach people around the world with just a click! They do find this method very useful.

Referral marketing goes side-by-side linked with network marketing/direct marketing. Social media is yet another network marketing prospecting tool to perform sales and reach.

Graze as a network marketing model!

The working or marketing style varies from one another in direct selling and normal sales. Graze as a network marketing model is entirely different from what they offer on their website. As mentioned earlier, the first box is half price and for that, the customer has to fill up the details and then subscribe to the graze box.

The subscription can be made for two weeks interval, a month or more and is subjected to alter. After the half-price boxes, the next boxes don’t come with any cut-offs.

However, when it comes to the network marketing model, the first box so referred is free of cost, isn’t that interesting? The next one with a half-price and again a free-bee! The strategy is only provided in network marketing and not for a direct customer who enters the website and makes a regular order. Become a distributor, buy your pack, and refer more to get more.

A proper plan is necessary and that’s why they have something unique in nature. The plan that attracts every health enthusiast with a graze box!

Proper use of every marketing channel, consistently engaging with the customers is the key! Even when one gets off from the graze subscription they come up with new offers to retain them.

A simple strategy with the best marketing scheme proposes an attractive option for worldwide customers. This case study tells how network marketing can be properly utilized with a unique idea and marketing plan. Be unique with a new plan that can revolutionize and make an impact in the world market!

They made a success story by their own effort, do you have similar innovative plans to make your marketing ideas work out well?

Now, if you check out the below stats and consider the above innovative idea, one important thing that lays a foundation will be the years of experience and out-of-the-box thinking. The company may have founded way back in the mid-’80s or after 2016 but if they have a good team with experience and talent then growth and brand recognition will be reflected easily in the sales revenue. To sustain long for the present and future, a direct selling or MLM company must consider this fact as too many home-based business kicks start every year.

MLM Distributor Stats & Insights

Network marketing distributors or salespeople in the industry have a major role to play and they choose this role either as a career or as a secondary income source. The success of a direct selling company relies heavily on its distributors and on the organizations' ability to provide its salesforce with the right tools for sales enablement. Distributors can contribute to both their own success and their company's growth by implementing effective routines and efficient strategies.

The industry proves worth enough, the numbers in terms of distributors as well as the revenue suggests it strongly. People also find the industry a good choice after the retirement period. Education is not a barrier in marketing but customer acquisition through proper prospecting techniques is a must needed skill to acquire. The best thing about being a distributor for an MLM company is that they can work remotely with their own schedule. Successful people in the industry often share network marketing tips and strategies, which distributors can use to establish a career in the field.

83.87% answered yes to this question.

Implies the acceptance of the business.

74% answered yes to this question.

Implies the opportunity direct selling provides.

84% answered yes to this question.

Implies the ease with which direct selling can be initiated.

Statistics on MLM distributors and sales representatives

- Direct selling industry has 102.9 million people as independent representatives and distributors.

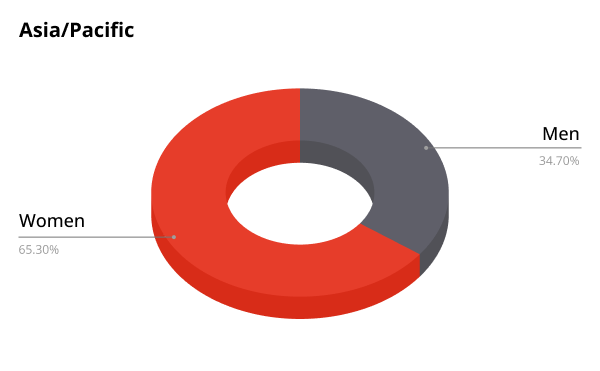

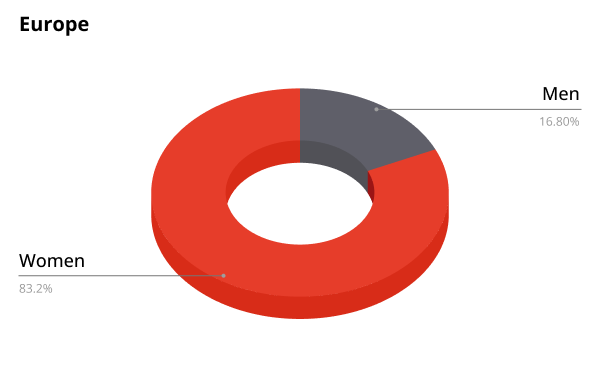

- 71.3% of people involved in direct selling are women.

- The industry's global salesforce dropped 4.9% year-over-year.

- 70 million people are actively working to build a full-time or part-time career and income from direct selling.

- Number of distributors participating full time in direct sales increased by 12%.

- 56% of direct selling employees reported feeling that they were paid fairly.

- In UK direct selling industry, about 500,000 people work within the direct selling industry as independent direct sellers.

- 64% of the direct sellers are working for a side hustle.

- Direct sellers in the UK earn $919 a month on an average.

- 95% of direct sellers in UK are Women.

- Canada has 1.1 million independent sales consultants in 2023.

- 1 in 3 canadians, which is 5% more than the previous year consider direct selling business to be a realistic option for earning additional income.

- Age cohort analysis reveals that 49% of independent representatives are in the 35-54 age group highlighting the fact that direct selling industry attracts individuals who are halfway through their careers.

- Further into the analysis, we can see that 25.9% belong to the 34 or younger age group.

- 24.8% are 54 and above, which is a clear indication that direct selling industry appeals even to older age group.

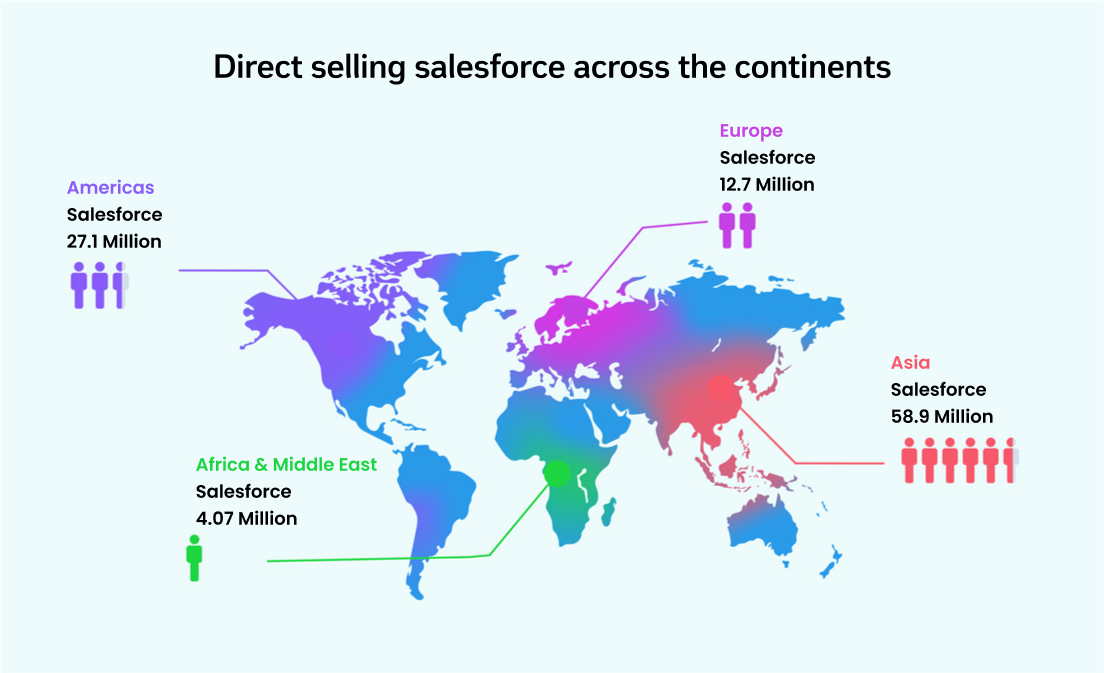

Global distribution of direct selling distributors in 2023

- The Asia Pacific region holds the largest direct seller base with 59 million representatives. This constitutes 57.3% of the global share.

- Americas leads right behind the Asia Pacific region with 27.1 million direct sellers marking a global share of 26.4%.

- Europe saw an increase in the number of direct selling distributors in 2023 with 12.7 million representatives. The global share of the European direct sales market in terms of distributors was a recorded 12.4%.

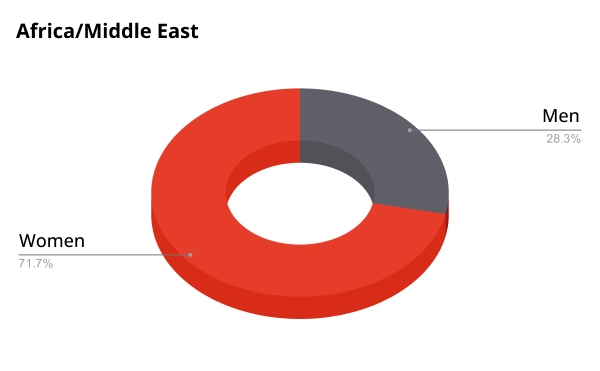

- Africa and the Middle East reported a decline in distributor numbers contributing to a global share of just 4%. The number of direct selling representatives in these regions was 4.1 million.

Salesforce trends in various global markets in 2023

- The European direct selling market expanded its seller base by 6% compared to the previous year.

- The direct selling representatives in the Asia Pacific region saw a cut down of –3.2% in 2023.

- The Americas despite being one of the popular direct selling markets saw a decrease by –9.2%.

- A major decline (-14.6%) in the number of direct sellers was noted in the direct selling markets of Africa and the Middle East.

Direct selling salesforce trends: Year-over-year analysis from 2019-2023

- The five-year period witnessed an acceleration in direct seller growth for Asia Pacific region.

- In Europe, direct seller growth rate declined by –10.2% from 2019-2023.

- The Americas also had a decline in the number of direct selling representatives entering the industry and the decline rate was at –11.2%.

- The lower penetration direct sales markets in Africa and Middle East did not contribute to the direct seller numbers, rather cited a decline by –36.8%.

Key insights on the direct selling salesforce trends for 2023

Asia Pacific makes a strong presence

- Asia Pacific dominates the global direct selling industry with 57% share in the number of direct sellers.

- The year 2023 saw a decline in numbers by 3.2%, however, the five-year report (2019-2023) shows a 2.8% increase in the number of representatives.

Declining trends in the Americas and Africa and the Middle East

- Americas suffered a significant decline of distributor numbers in 2023 by 9.2%. The five-year report for the region also indicates a decline of 11.2%, possibly attributed to challenges like market saturation, increased competition and changing customer preferences.

- The decline levels in Africa and the Middle East were sharp at 14.6% in 2023 and 36.8% from 2019-2023. The direct selling market in the region is impacted by serious challenges related to socio-economic conditions and regulatory complexities.

Europe’s growth holds hope for the future

- Europe stood out in 2023 as the only region to experience growth in salesforce with a moderate increase of 0.6%.

- The 2019-2023 period does not show well for Europe with the region marking a 10.2% decline in salesforce growth.

The recent progress could possibly be a change in strategies or preferences as exhibited in the region.

Reversing the declines and finding new opportunities for growth

Gearing up for growth in the strong Asia Pacific

- Direct selling companies must analyze the reasons for the recent decline. However, the growth trends in the five-year period (2019-2023) suggest a strong need for more strategic investments and innovative business approaches.

- Companies must implement the right measures to counter the decline trend with tailored compensation structures and product launches in the Asia Pacific market.

Addressing the hardest of challenges in the Americas and Africa and the Middle East markets

- The American markets badly need a rejuvenation with diversified product offerings, competent digital sales platforms and attractive recruitment efforts to turn the decline into growth.

- African and Middle Eastern markets can be strengthened with innovative approaches such as localized business models and local partnerships. Addressing cultural and economic barriers will also be crucial to ensure higher adoption rates for direct selling in the region.

Focusing on the growth trends in the Europe

- Europe holds great potential for direct selling companies to expand their network as is evident in the improved growth rate in 2023.

- Targeted marketing, impactful training programs, attractive compensation structures and strong support systems can drive more Europeans to direct selling.

- Adopting sustainable strategies will also help prevent a decline in the future.

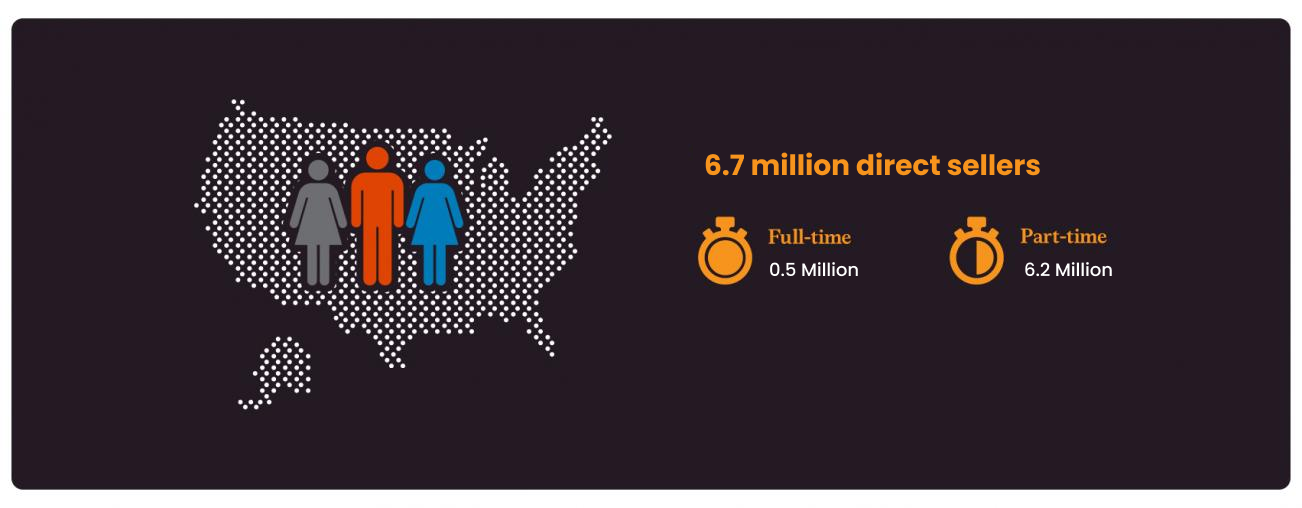

Some interesting MLM statistics about direct selling salesforce in US

- There was increase in direct sellers’ average retail sales to $6,045 in 2022 (+3%).

- The number of direct sellers in US decreased to 6.7 million, a decrease of 8% from the last year.

- 0.5 million direct sellers of US work for full-time.

- 6.2 million direct sellers of US work for part-time.

- California has the highest number of people involved in direct selling - 1,525,948 . The state also contributes the highest retail sales - $5.3 billion.

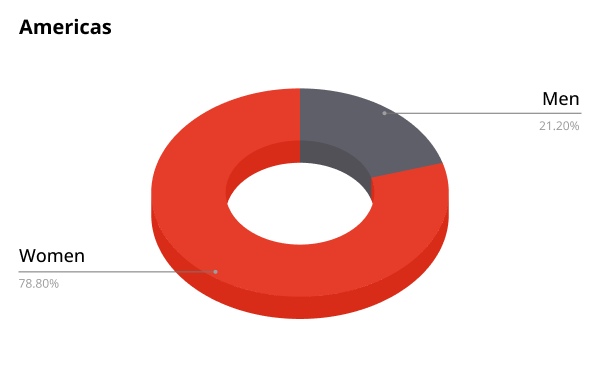

- 75% of direct sellers in US are women and 25% are men.

- 23% of distributors belongs to the hispanic community.

- The racial distribution of the direct sellers in US is 83% White/Caucasian, 9% Black or African American, 3% Asian, 1% Native Hawaiian/Pacific Islander and the remaining 3% belongs to other categories.

The more engaged the distributors are, the more they earn. The MLM facts and figures also indicates that those who choose direct selling as a profession are highly motivated.

An interesting fact to note is that among the top 100 earners in the direct selling industry, couples earn higher income than individual direct sellers. Men and women, together as partners, have the ability to acquire leads from both genders. However, direct selling organizations must ensure proper training tools and features and marketing strategies to improve distributor engagement, despite the potential of distributors.

Some interesting MLM statistics about direct selling salesforce in Europe

- 85% of direct sellers in Europe are women.

- 93% of direct sellers in Europe work only for a single direct selling company.

- 47% of European direct sellers reported an annual income of $3598.52 or less.

- 86% direct sellers in the Europe consider direct selling as an option to meet new people.

- About 41% of direct sellers has bachelors, master's and above level of education.

- 78% direct sellers in Europe are satisfied with the overall direct selling experience.

- 72% agree that direct selling has met or exceeded their expectations.

- 77% of European direct sellers admit that direct selling has considerably improved their interpersonal skills.

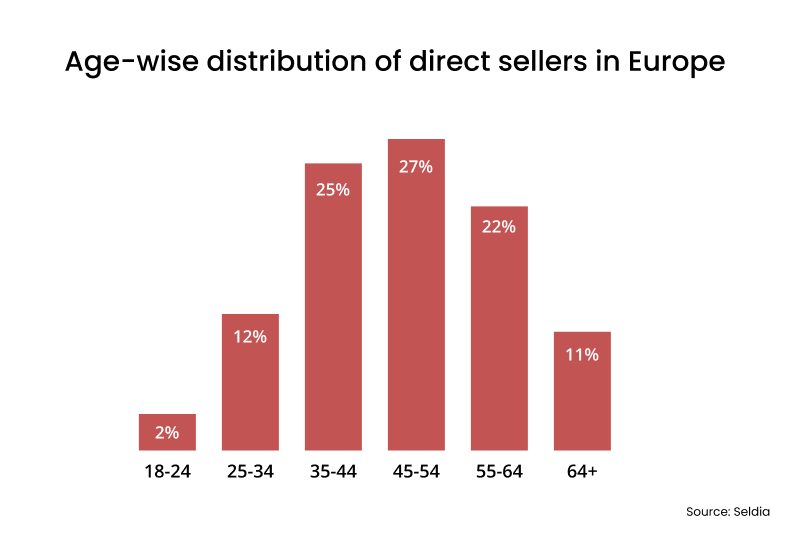

- Majority of direct sellers in the Europe belong to 45-54 age group (27%).

- 74% of European direct sellers belong to 35-64 age group.

- 3 out of 5 European direct sellers are aged 45 or older (Up by 18% since 2018).

- Compared to 2018, direct sellers in Europe aged 35 has decreased more than half, from 32% in 2018 to 14% in 2023.

MLM Product Stats & Insights

The most important ingredient in the industry that connects every group is the product. After all, the meaning and the goal of this business model is to sell products and if the product selling is not the goal then you have to take a close on it as it falls under illegal pyramid schemes.

Among the products, there exist many categories and direct selling is the best available business model to reach them to the end-users, i.e the consumers and then the customer-distributor conversion that helps product selling companies to make products distributorship revenue. A part of the revenue is shared with the distributors as commissions and bonuses depend on the marketing plan & criteria to achieve it, set by the companies.

The growth rate in sales revenue for each and every category displays one important agenda -popularity of the product. Companies can use these network marketing statistics and customer suggestions to pull out the magnet and thereby acquire more customers. Just like the food processing companies use the awareness of human beings' cravings and tailor the tastes of their food products to ignite the addiction or their taste interests.

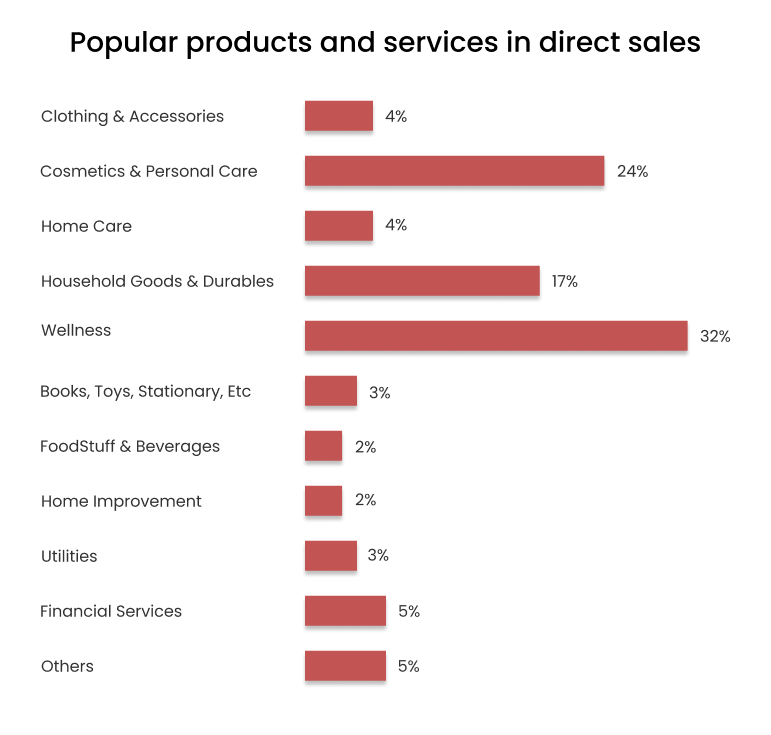

- Most popular product categories in direct selling in 2023 are wellness, cosmetics & personal care, and household goods & durables.

- In 2023-24, wellness products shared 32% of retail sales globally.

- Cosmetics and personal care products companies contributed 24% to annual retail sales.

- 17% of global network marketing sales comes from household goods and durables.

- 64% of individuals find product discounts as a motivational factor to choose direct selling as a career.

- Health and beauty products showed the highest growth rate of 239% (Chogan) among the product/service categories (based on the top network marketing companies list of 2023).

- Wellness topped the product category across the regions and made $64.8 billion in 2021.

- Cosmetics and personal care products made $45.6 billion followed by household goods & durables with $29.8 billion in 2021.

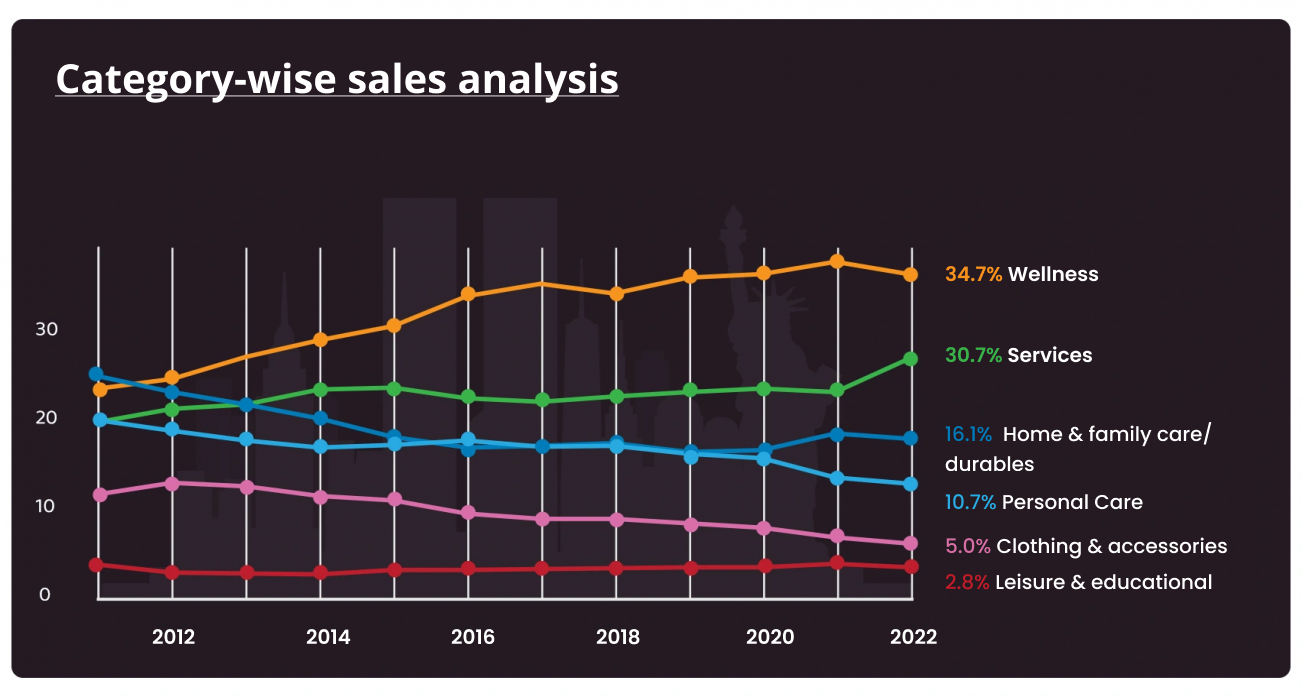

Retail sales by product categories in US for 2023

- Wellness products top the list with 32.4% of retail sales in 2023.

- 33.7% of the sales is contributed by the services category.

- 16% comes from home and family care/durables.

- Personal care products shared 10.2% of annual retail sales.

MLM Consumer Stats & Insights

Consumers are those end-users who ultimately use the products and remark their opinion at least in mind. If they are happy with the products then they will be using it until something new comes up that satisfies their needs by means of new offers from other competitors, finding more satisfying customers for other brands, or anything that triggers the interests.

This particular point has been constant trouble for direct selling companies and those who attained customer retention have survived for long. Product consistency needs to maintain throughout their existence and customer fulfillment is a major battle to compact around.The point of success lies in knowing your customer needs while implementing a customer-centric approach.

Different age groups have different levels of criteria that make them pick a product from different available brands. The success of a business is once all such age groups together choose your brand. If the senior citizens still argue over your product in the later period of their life in supermarkets or similar brick and mortar stores then you can define a product as the best and evergreen product with never-ending trust.

- There are 37.7 million preferred customers and discount buyers in the US.

- The number of US customers decreased 8% over 2021.

- Preferred customers in US are 30.8 million.

- Discount buyers in US are 6.9 million.

- 40% of direct selling markets are reporting inclusion of preferred member programs by their member companies, with almost 30 million participants in these programs reported in 2021.

- In the US direct selling prospects are diverse with 20% African Americans.

- 48% of direct selling prospects are women.

- Millenials share 35% of the direct selling prospects.

- US consumers have positive perceptions towards direct selling and this has remained stable over the past 10 years.

- 69% find supporting small businesses as an appealing attribute of direct selling.*

- 67% are inclined to the personalized service that direct sellers provide.*

- 46% of Americans would welcome contact from direct sellers regarding business opportunities on social media.*

- The deciding factor in the purchasing choices for 32% of shoppers was the protection of their health and their family.

- 76% says product quality was the top reasons for utilizing direct selling.

- Relationship with sales consultant (71%) and customer service (47%) were the next reasons.

Sales need to focus on the younger generation too as they are the future and having their trust in a product means a lot. More efforts have to be put forward for younger, older generations to collectively call business as a complete world-class choice! Similar sorts of actions have to be done on the gender side too, a balance has to be kept among them which lacks at present. A study can be made to find the cause and how to overrule it as a perfect solution which remains stable for the future.

- In 2021, 9% among the overall direct sellers is aged 18-24.

- People aged 25-34 constitute 21% of the global direct selling population in 2021.

- About 25% who contributed to the direct selling crowd were from the age group 35-44 in 2021.

- 23% among the direct sellers were from the age group 45-54.

- 22% of the direct sales consumers belong to the age group 55 and above.

- About 74% of the customer/direct sellers are women and 26% are men.

- Gen Z now accounts for nearly 10% of the industry.

- 91% of GenZers are interested in flexible income earning opportunities.*

Discover how we build resilient businesses with advanced MLM functionalities

MLM Entrepreneur Stats & Insights

The final entity or the important step in this ladder is the ‘entrepreneurs’. The entrepreneurs have to look into the system deeply from industrial history to the consumers’ reaction over the products. This particular group has to study a lot and at the end of the day, they go for industrial expert opinions and consulting.

Is that necessary? Yes, it is but to an extent this article can help you to look around the whole system without many dilemmas. The reason behind it is that the article is written purely based on network marketing statistics and facts, and have omitted any data that doesn’t have an accurate basement to stand for.

As an entrepreneur, you can use the data above to find and sketch a pattern that lets you dominate the business, no worries! We can help you with that part and make you clear with more network marketing facts. However, there are more things you have learned before we help you come up with a solution.

- 77% of Americans are interested in flexible, entrepreneurial/income earning opportunities.*

- 88% of millennials are interested in entrepreneurial opportunities.*

- 79% of Americans consider direct selling as an attractive option for entrepreneurial opportunities.*

Direct selling has been and will always be the best platform to do business for your products and take in as a business model for marketing them to consumers. Let’s see some interesting stats that might help you to analyze if the industry is suitable for you or not.

- 5.1 million people found entrepreneurship opportunities in the direct selling industry.

- Direct selling requires a minimal start-up cost of $82.50 when compared to other industries.*

- There are 114% more women entrepreneurs than there were 20 years ago.

- Top 3 US states for female startup entrepreneurs in 2022 are Colorado, Washington and California.

- Female entrepreneurship has been growing at a rate of 5%.

- The direct selling female salesforce outnumbered men in 2023 marking a 70% presence. However, the direct selling industry also witnessed an interesting increase in the number of male direct sellers.

- Recent report from Global Entrepreneurship Monitor (GEM) shows that 1 in 6 women plan to launch a business soon, a potential opportunity for the direct selling industry to host women entrepreneurs.

- Among aspiring female population looking for entrepreneurship opportunities, 73% women consider job scarcity as a reason to enter business.

- 36% women manage their business independently.

- 49% women are interested in launching wholesale or retail business utilizing business opportunities like direct selling.

- As of 2023, there are 52 female CEOs employed at Fortune 500 companies. This number actually translates to 10.4% of women CEOs at the top of America’s 500 highest-grossing companies.

- Women-owned businesses now account for 30 percent of all U.S. enterprises and are generating approximately $1.5 trillion in revenue.

The below table lists the top 10 earners in the network marketing industry along with their company and income details.

Top 10 MLM Earners

| Rank | Name | Organization | Country | Annual Income (est.) | Lifetime Income (est.) |

|---|---|---|---|---|---|

| 1 | Ada Caballero | Vida Divina | Mexico | $14,400,000 | $2,000,000 |

| 2 | Sandro Cazzato | Chogan | Switzerland | $8,484,000 | $9,950,000 |

| 3 | Hilde & Orjan Sæle | Zinzino | Norway | $8,160,000 | $63,000,000 |

| 4 | Yager Family | Amway | USA | $7,200,000 | $480,000,000 |

| 5 | Gustavo Salinas | ByDzyne | Ecuador | $7,143,312 | $4,000,000 |

| 6 | Stefania Lo Gatto & Danien Feier | Jifu | Italy, Germany | $6,720,000 | $41,000,000 |

| 7 | Joachim Heberlein | PM International | Germany | $6,420,000 | $53,000,000 |

| 8 | Jeff Roberti | Juice Plus+ | USA | $5,400,000 | $106,000,000 |

| 9 | Lisa Faeder Grossmann | Pruvit | USA | $4,200,000 | $35,000,000 |

| 10 | Marcell Rodriguez | ByDzyne | Ecuador | $3,920,028 | $3,000,000 |

Transformative changes in the direct selling industry: Traditional vs modern approaches

1. Face-to-face meetings vs Online meetings

Not to mention, face-to-face meeting is vital to establish a strong relationship with your distributors as well as customers. It has always served as the easiest way to effectively communicate with them, and to build a bond of trust.

Thanks to the advanced online meeting facilities available in today's tech world, it has been able to simulate a real experience with extra ordinary audio and video qualities. With its help, direct sellers are successfully hosting online parties and knowledge transfer meetings, to keep the community together strongly. Since this method has been able to gratify customers, it is one of the reasons why direct selling was able to beat all the odds created by the COVID-19 crisis.

2. Offline sales vs Online sales

Most of the direct sales products were sold offline, since it was comparatively easy to demonstrate the product and also to have a one-on-one conversation with the customer. More and more direct sellers are moving to online platforms to set up their virtual stores. Not only the selling process is simplified, but also the sellers can get more insights into customer behavior and their preferences to a greater extent. Online sales also help in expanding the customer base without any geographical boundaries, which offers a great opportunity for business expansion as well.

3. Word-of-mouth vs Digital marketing

Right from the time direct selling flourished, most of the marketing part was done offline through word-of-mouth. It had an upperhand in productive sales establishment, since the review about a particular product came from a known person or a peer group. This type of marketing happened during social gatherings and similar occasions. Sellers are now more focused on branding their company online by putting their time and effort into employing the latest trends in marketing and sales in their business. Online campaigns, co-branding, point of purchase (POP) marketing, programmatic advertising, etc. are some of the strategies commonly deployed today.

4. Physical back-office vs Online back-office

The successful implementation of work from home scheme has made companies rethink the need for an expensive office space, since most of the companies could get their work done in WFH method with a great reduction in running costs. To enforce this without any flaws, companies are moving to virtual back-office MLM platforms, which integrates all essential features needed to run a multi-level marketing company as if it was running offline. The betterment in technology has also made this approach seamless.

Direct selling industry has undergone remarkable transformation fueled by economic, cultural, and technological factors. The advent of technology, changes in consumer behavior, challenges in the global marketplace, and the undying need for innovation has shifted the industry to adopt modern approaches. As we move forward, adapting to the most modern methods in the field of technology, customer relations, network management, and global operations will continue to shape the future of direct selling businesses in the new era.

References

dsa.org

wfdsa.org

ipsos.com

businessforhome.org

directsellingnews.com

*DSA 2020 Consumer Attitudes and Entrepreneurship Study conducted by Ipsos.

Disclaimer: Epixel neither promotes nor supports any of the companies mentioned in this article nor their products or services. The facts published here are represented as reported in the direct selling industry. The facts don't reflect our priorities. The article was compiled based on available resources and does not represent special mentions or priorities to organizations, persons, or products.

Lal Mani