The Asia/Pacific region is a promising hub for direct selling businesses and entrepreneurs looking to succeed in today’s rapidly changing retail landscape. The region has remained resilient and has shown great growth potential even after experiencing the recent ups and downs. To thoroughly analyze this, we at Epixel have drawn on World Federation of Direct Selling Associations’ (WFDSA) stats to highlight:

- Latest retail sales trends

- Country-specific insights

- Salesforce overview

Alongside our data analysis, we’ve also included strategic recommendations designed to guide direct selling enterprises toward growth and success in the Asia/Pacific market.

Overall direct selling retail sales trends in Asia/Pacific

Steady growth excluding China

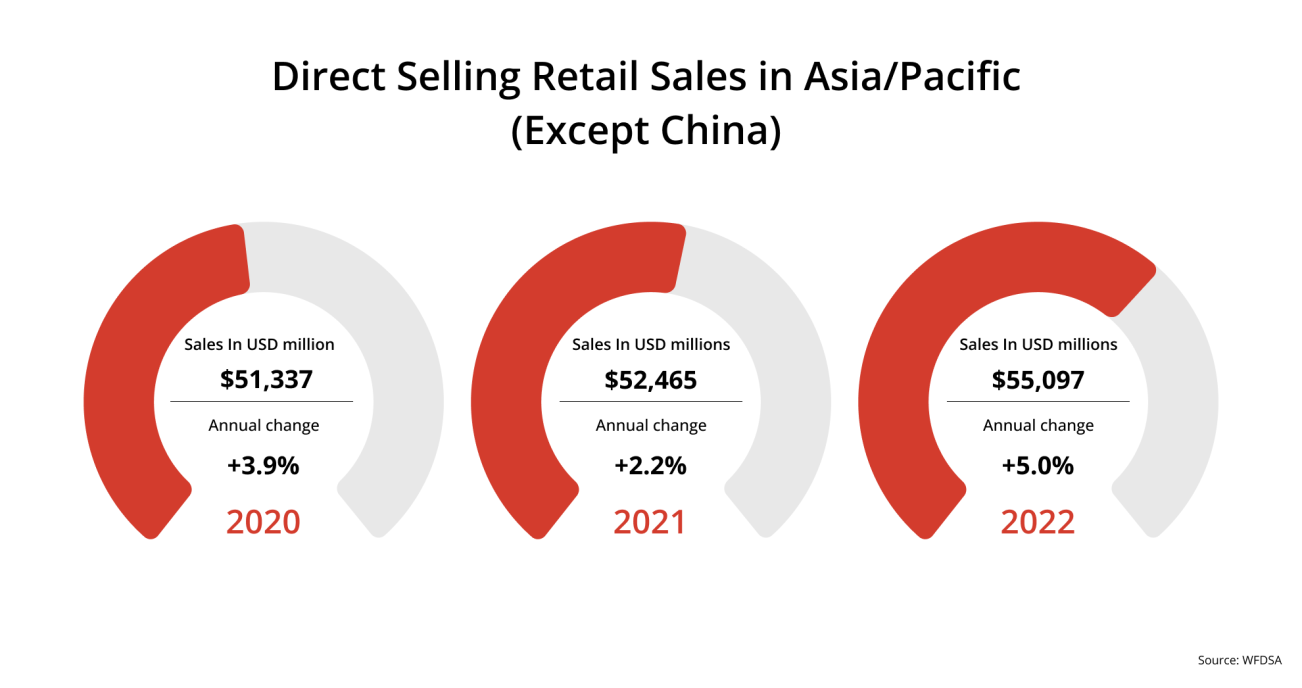

Direct selling retail sales in the Asia/Pacific, except China region, experienced rapid growth for 2019-2023. In four years, the sales moved from $49,428 million to $52,530 million which means a 6.3% yearly rise. The annual growth figures from 2020-2022 depict an upward slope:

The year 2023 showed a downward trend of 4.7% growth rate with $52,530 million. The long-term growth still remains positive and thereby denotes strong as well as organic growth momentum. This steady expansion provides fertile ground for direct selling businesses to capitalize on emerging opportunities.

China’s contrasting performance

China has been on the reverse end here as the region's direct selling retail sales drastically decreased from 2020 to 2022:

By 2023, sales improved as the post-pandemic recovery took hold. Thanks to the lifting of the Zero COVID policy and easing of other disruptions. This marked the right chance for direct selling businesses to strategically re-enter the Chinese marketplace on much surer footing than before.

Country-specific insights

Hong Kong

Retail sales decline and market shifts

In 2023, the retail sales in Hong Kong fell 11% to $355 million. This decrease is largely because online shopping for fast-moving as well as high-trend products has now gained wide acceptance. Also, the soft, fluctuating economic state forces the consumer to use less expensive and fewer products or services.

Salesforce dynamics

- Member preferred customers: Decreased from 95,000 in 2022 to 83,000 in 2023.

- Independent representatives: Slight decline of 1% stood at 233,000.

- Business builders (actively engaged): Up by 8% to 90,000.

Strategic recommendations

- Attract younger generations: Revamp marketing strategies to employ more modern imagery and language. This will be well-received by the younger demographics.

- Embrace ESG principles: Adopt and integrate ESG values (environmental, social and governance) into your business model.

- Expand opportunity values: Go beyond income and highlight personal growth and community aspects to attract and retain representatives.

Korea

Retail sales trends and challenges

From 2019 to 2022, Korea witnessed an increase in retail sales from $15,783 million to $18,274 million (+15.8%). However, in the year 2023 it fell by 10.8% to $16,298 million (WFDSA Global Retail Sales report). This was due to reduced household consumption and disposable income influenced by higher rates of interest.

Salesforce trends

- Aging workforce: The salesforce is aging. This calls for specific initiatives to attract a younger sales representative through social media.

- Gender dynamics: Women represent 79% of the salesforce, far above the comparable figure of 47% for new Korean sole proprietorships.

- Entrepreneurial interest: 38% believe there are good opportunities to start a direct selling business, while 55% rely on the social engagement aspect.

Strategic insights

- Target younger demographics: Leverage social media platforms as an effort to reach a much younger, more diverse salesforce.

- Maintain gender diversity: Keep supporting and expanding the high percentage of female representatives because women constitute a significant market presence in the first place.

Taiwan

Impressive retail sales performance

2023 retail sales for Taiwan increased by 23% to $4,530 million from 2022. The outlook for 2024 is quite impressive: 46% of network marketing companies are expecting a major increase in their revenues and only 14% believe that their retail revenue will go down. The remaining 40% anticipate flat retail sales.

Market trends

- Core value: Personal interactions continue to show strong demand.

- Evolving lifestyles: With the rise of ecommerce and social selling, the traditional person-to-person contact is starting to take a back seat.

- Competition: Though social media influencers bring in competition, direct selling remains a reliable income source with minimal entry barriers and full support.

Salesforce dynamics

- Women representation: 72% of the salesforce are women while in new sole proprietorships, this percentage is 37%.

Strategic recommendations

- Leverage social media: Partner with influencers and utilize digital platforms to increase visibility and drive sales.

- Support young entrepreneurs: Provide training and well-defined business plans to attract and keep younger representatives engaged for long.

Thailand

Retail sales trends and market dynamics

Reports from WFDSA show that retail sales in Thailand have decreased by 6% in 2023 to $2,161 million. At the same time, demand for wellness products and attraction toward independent work among young people is growing very strongly. All these evolving trends are very promising overall.

Market trends

- Wellness products: Direct selling companies are coming to fill the expanding space of health and wellness-related products.

- Online sales proficiency: Direct sellers are sharpening their digital skills to boost online sales.

- Independent work: The more youthful age ranges have shown more inclination to engage in independent business opportunities.

Competitive landscape

- Competitors: Online content creators and gig economy platforms are emerging as tough competitors.

- Competitive advantages: The personal touch and custom product picks give direct selling an edge over gig platforms.

Strategic insights

- Innovate product offerings: Offer wellness and relevant trending product categories to appeal to changing consumer preferences.

- Enhance online selling skills: Improve online selling capabilities as the retail environment changes.

Salesforce overview in Asia/Pacific

Total representatives and regional distribution (2023)

- Asia/Pacific: 59.0 million (57.3% of global salesforce)

- Americas: 27.1 million (26.4%)

- Europe: 12.7 million (12.4%)

- Africa/Middle East: 4.1 million (4.0%)

Salesforce growth in 2023

- Asia/Pacific: -3.2%

- Europe: +0.6%

- Americas: -9.2%

- Africa/Middle East: -14.6%

Historical salesforce changes (2019-2023)

- Asia/Pacific: Increased by 2.8%

- Europe: Decreased by 10.2%

- Americas: Decreased by 11.2%

- Africa/Middle East: Decreased by 36.8%

Key insights

- Dominance of Asia/Pacific: The region represents 57.3% of the global salesforce, with 59.0 million and continues to be the epicenter of direct selling operations.

- Declining salesforce in other regions: The Americas and Africa/Middle East are declining at a steep rate and this is a sign of potential market challenges.

- Europe's minimal growth: The region is stable but not seeing much expansion.

Strategic implications

- Asia/Pacific: Invest and innovate further to maintain and expand growth, while reversing recent declines with targeted strategies.

- Americas and Africa/Middle East: Examine the root causes of decline and develop local strategies to restore the salesforce and market presence.

- Europe: Leverage the small growth as a springboard to sustain the momentum while dealing with long-term decline through sustainable growth initiatives.

Top 7 Asia/Pacific direct selling markets performance

Market performance highlights

- Positive performers:

- Malaysia: +8.1%

- India: +8.3%

- Taiwan, China: +2.3%

- Negative performers:

- China: -7.0%

- Japan: -3.2%

- Thailand: -6.6%

- Indonesia: -6.0%

Key insights

- Robust growth in Malaysia and India: Indicators of healthy market and sound direct selling strategies.

- Modest growth in Taiwan: In line with its overall positive trend.

- Challenges in China, Japan, Thailand and Indonesia: The impact on direct sales may include economic fluctuations, regulatory issues and shifting consumer behaviors.

Strategic implications

- Focus on high-growth markets: Double down on investments in Malaysia and India to capitalize on their strong performance.

- Address challenges in declining markets: Use targeted approaches to address challenges in China, Japan, Thailand and Indonesia, such as boosting online sales or diversifying product offerings.

Discover how we build resilient businesses with advanced MLM functionalities

Strategic recommendations for the Asia/Pacific direct selling industry

Embrace digital transformation

- Leverage ecommerce and social media:Transcend your traditional border by reaching out to a wider audience through the use of digital platforms.

- Invest in digital training: Implement digital distributor training programs to guide and help your network marketing representatives excel in online sales.

Focus on product innovation

- Develop wellness and trending products: Introduce product lines such that they can cater to changing consumer needs, especially on the MLM wellness front.

- Cater to regional preferences: Innovate new product categories that would be in tune with cultural values that exist in that region.

Attract and retain young talent

- Modernize marketing strategies: Use contemporary imagery, language and values relevant to younger generations in your multi-level marketing network.

- Provide comprehensive training and support: Equip both new as well as existing MLM representatives with all the tools, resources and knowledge required to get ahead.

Enhance ESG integration

- Incorporate ESG principles: Adapt your business models to include environmental, social and governance values in order to attract socially responsible consumers and representatives.

Localize strategies

- Develop region-specific approaches: Address unique market dynamics, regulatory environment and local cultural factors with strategies tailor-made for each region.

- Form strategic partnerships: Enhance your position in the market and garner credibility by collaborating effectively with local entities.

Support female entrepreneurs

- Empower women representatives: Sustain the high percentage of female multi-level marketing representatives through focused programs and resources.

- Highlight success stories: Empower women in direct selling through mentorship and celebrate successful female entrepreneurs to encourage more women to join and grow in direct selling.

Future-proof your direct sales

Asia/Pacific forms the bedrock of direct selling globally. WFDSA’s recently published research reports confirm that the region accounts for 57.3% of the global salesforce and is still seeing growth in retail sales despite facing some recent challenges. An example of good performance would be markets like Malaysia and India, but other markets like China and Thailand have more hurdles that need to be passed by the companies. The region’s strong ability to bring in a huge, mostly female-oriented salesforce, opens wide the doors for sustainable growth.

With a strong focus on digital transformation, innovative product offerings and localized, ESG-driven strategies, direct selling companies can navigate recent declines and seize emerging opportunities. With such strategies, the Asia/Pacific direct selling industry will continue to thrive and evolve to meet the ever-changing landscape of the global market.

Ready, set, go!

Let these insights and strategies help you power up your business and unlock incredible growth and success in the vibrant Asia/Pacific region.

- Overall retail sales trends

- Country-specific insights

- Hong Kong

- Korea

- Taiwan

- Thailand

- Salesforce overview

- Top 7 Asia/Pacific markets

- Strategic recommendations

- Digital transformation

- Product innovation

- Attract and retain young talent

- ESG integration

- Localize strategies

- Female entrepreneurship

- Conclusion

Leave your comment

Fill up and remark your valuable comment.