Synopsis

How tough is managing finances? Finances vary drastically for every denomination, decimal, and percentage if not handled right. MLM financial services does just that. Providing individuals and businesses with financial services including investment opportunities, insurance, and wealth management.

Finance as such is sensitive. So, for an MLM business that deals with financial information and transactions ensuring data security could be quite a challenge. In the view of the rise in cyber threats and compliance regulations put forth by GDPR and CCPA imposing stringent data protection measures, our customer recognized the importance of reinforcing their business capabilities by integrating advanced data security solutions.

Problem

An MLM financial services business lacked a strategic approach to address challenges pertaining to data and security. Irrespective of continuous efforts to integrate sophisticated features, the business failed to keep up with security standards.

Considering the necessity of safeguarding the business and the stakeholder’s reputation and emerging as a trusted entity in the MLM industry, the brand had to have a meticulous data security framework.

The failure to uphold the confidentiality of customer data and allied financial information necessitated the integration of a comprehensive data security structure.

Solution

While preventing data security shortcomings is a business responsibility, having a complete understanding of the existing structure is crucial. Then comes the need to analyze the room for improvement and integrating an infrastructure that can complement growth and success. Beyond preventing cyber threats, staying in compliance with regulatory standards and increasing awareness among distributors and customers about data privacy issues beholds prime importance. Enhancing their brand trust and streamlining operations were the other key factors to consider before devising a new strategy.

Epixel MLM Software, pioneers in solutions for financial companies, took charge of the situation and ran a diagnosis to identify how to rectify the security shortcomings and enhance the business capabilities of our customer to help accelerate their growth and success.

Sophisticated encryption standards

No level of security can ever be considered excessive for a highly confidential and classified MLM business like finance. Implementing the most advanced encryption techniques, built a shield over sensitive data that includes customer financial and personal information, transaction records, distributor details, and every other organizational data. It also kept data indecipherable at any instances of unauthorized access or disruptions.

We then focused on introducing a proactive approach to mitigate the risks of cyberattacks and unauthorized access. By building a secure network infrastructure incorporating firewalls, intrusion detection systems, and standard security audits. Micro-segmentation was another wise implementation that enhanced data protection and helped lower every risk pertaining to brand credibility and customer trust.

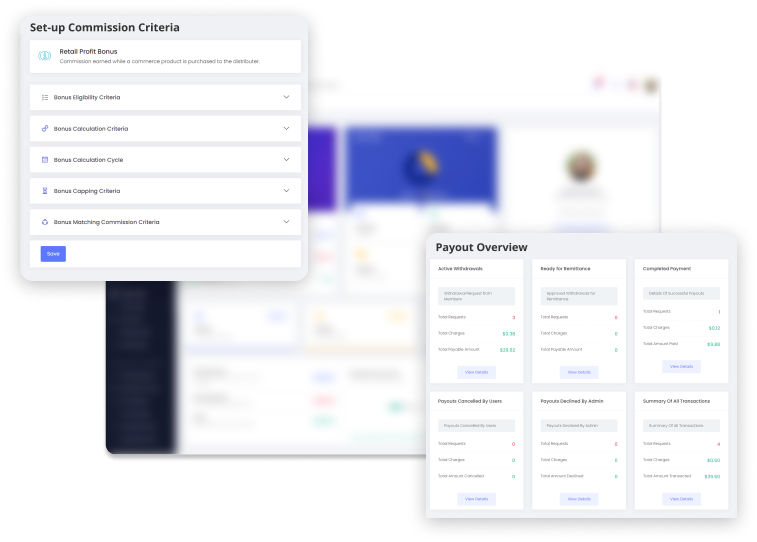

Payment management system

There is a certain amount of complexity already existing in financial businesses for the enormous calculations involved in it. In an MLM context, a vast distributor network and complex commission structures add up to the load hampering the brand’s transparency and timely payouts. Revamping the compensation management structure was our foremost strategy to simplify complex commissions and calculations. Introducing a user-friendly dashboard helped distributors view their earnings, downline performance, and bonuses in real-time, leaving no room for distrust or dissatisfaction within the network.

Manual payments were replaced with an advanced payment management system that automated every payment process from fund disbursement to payment reconciliation. Payment automation also enabled timely payouts which helped enhance distributor trust and effective retention. Strict adherence to payment management regulatory requirements like AML (Anti-Money Laundering) and KYC (Know Your Customer) protocols improved business efficiency fostering trust and loyalty within the network.

Legal and regulatory compliance

As if data breaches and security breakdowns were not enough to devastate the well-being of an organization, the legal repercussions and costly penalties could disrupt the functioning of finance MLM businesses. For every customer we deal with, ensuring compliance is something we focus strongly on irrespective of what is expected from us. Rest assured, staying in compliance with the highest data protection regulations like GDPR and CCPA helped strengthen the company’s reputation as a reliable and compliant organization that safeguards customer data with utmost security.

We also monitored compliance to keep data policies in line with changing industry and regulatory standards. PCI DSS compliance, which is a fundamental safety cover to fasten payment protections, was effectively carried out. This ensured that all payments and transactions were safe from phishing or fraudulence.

Access control and management

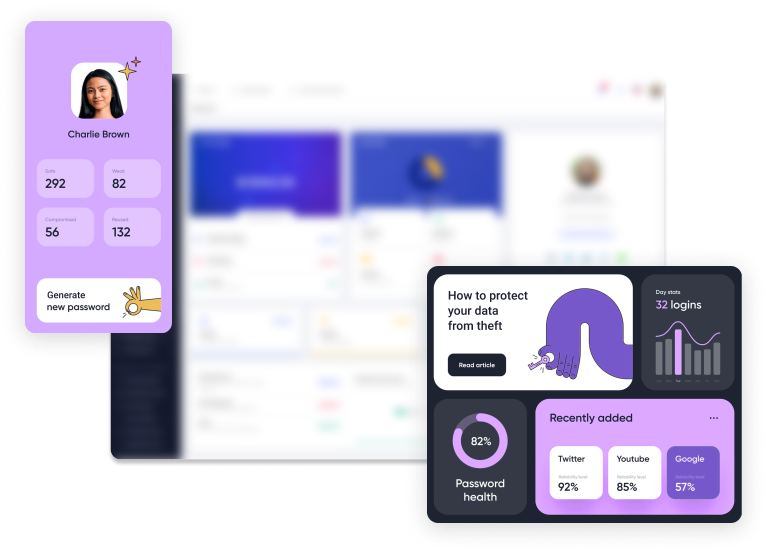

For an MLM business dealing with finance management and services, access to sensitive data and critical systems needs tight control. Implementing multi-factor authentication techniques, Single Sign On (SSO) and role-based access controls ensured that only authorized individuals involved in the business could access sensitive information thus minimizing the threats caused from within the organization.

Next-generation authentication methods like MFA tokens and certificate-based authentication were introduced to prevent any chances of security breaches or attacks. Temporary access was monitored thoroughly from time to time and suspended automatically after a definite period. Access credentials were updated with new security questions, passwords, and encryption keys occasionally to ensure that every potential threat is ruled out and the system is secure.

Data audit and threat assessment

Systematically reviewing and analyzing the business’s data handling practices, security measures and potential vulnerabilities is a necessity as the business grows. We incorporated strategies to conduct regular audits and threat assessments to enhance growth and safeguard the business from potential fraudulence. This begins with data inventory, which identifies all types of data collected, processed, and stored by the MLM business including customer data and sensitive business data. Identifying potential vulnerability points and mapping out data flow was the next thing to do to strengthen security measures wherever they are lacking.

We also efficiently evaluated existing security controls to gauge their effectiveness and how they would respond during an instance of threat or security outbreak. Having an incident response plan in place helped to ensure business continuity minimizing disruptions. In case of security uncertainties, the predefined procedures enabled the business to swiftly and effectively respond and rectify the incident and facilitate seamless business operations.

Challenges Faced

Although we succeeded in rightly diagnosing the conditions and efficiently fixing them to help enhance the growth and success of the business, the primary challenge we had to tackle was the complex network infrastructure. Ensuring consistent security standards are maintained across all the business locations and an extensive network of distributors was quite a task. However, we took it slowly and paced up steadily to uniformly set the system across all business areas ensuring utmost safety and security of the business.

Yet another challenge that worried us more than usual was the sensitivity of data entrusted to our customer by its customers and distributors. It was an additional responsibility to maintain its secrecy with heightened security. Being aware that any compromise in data security could hamper the brand's financial integrity and reputation kept us more vigilant throughout our operation.

Expected Results

Enhanced customer trust

24%

Lesser risks of cyber-attacks

19%

Lesser customer attrition

22%

Increased sales

17%

Improved data quality

19%

Decrease in security threats

31%

Effective encryption

100%

Improved transactional security

33%

Higher distribution retention rate

29%

Lesser payout processing errors

24%

Enhanced customer trust

24%

Lesser risks of cyber-attacks

19%

Lesser customer attrition

22%

Increased sales

17%

Improved data quality

19%

Decrease in security threats

31%

Effective encryption

100%

Improved transactional security

33%

Higher distribution retention rate

29%

Lesser payout processing errors

24%

Rev up your business integrating cutting-edge data security features

Free Demo