Join the 100+ companies using the Epixel platform

1M+

users powered by Epixel MLM Platform worldwide

Epixel supports millions of MLM users across the globe.

200%

return on investment

Our customers experience exceptional revenue growth and efficiency with Epixel.

30-50%

increase in Sales & Recruitment

MLM companies report significant business impact in Sales & Recruitment with Epixel.

Core challenges in the financial services industry

Complex regulatory environment

Financial services operate within a stringent and complex regulatory framework that is frequently updated and varies across regions. This requires constant vigilance and adaptation.

Financial product personalization

Tailoring financial services and products to fit the unique needs and goals of individual clients, while maintaining scalability and efficiency, is a delicate balance.

Risk management

Identifying, assessing, and mitigating financial risks in a proactive manner, particularly in an environment where products and services are distributed through a broad MLM network can be challenging.

Technology utilization and integration

Leveraging emerging technologies to enhance service delivery without compromising on reliability or introducing undue complexity into the financial ecosystem.

Client data security

Protecting sensitive financial data against increasingly sophisticated cyber threats, breaches, and ensuring privacy in compliance with global standards like GDPR and CCPA.

Market volatility and investment education

Helping clients navigate market volatility with informed advice and ensuring representatives have the tools to provide up-to-date, accurate financial guidance.

Transform complexities into opportunities with a promising MLM platform for financial services

Free DemoEnhanced features of MLM financial services software

-

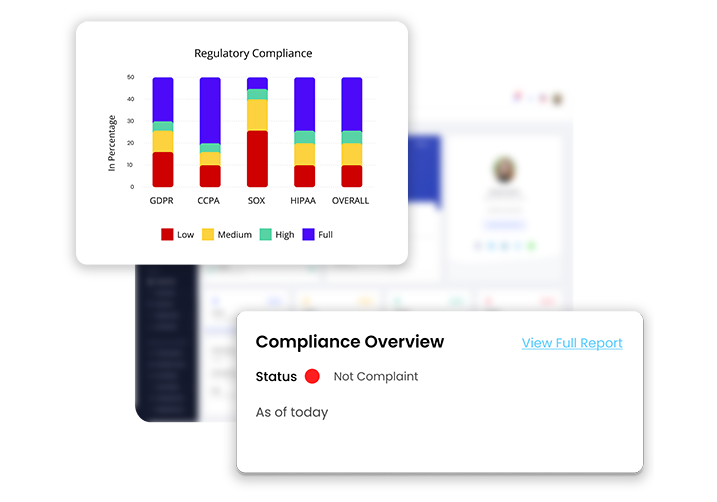

Dynamic compliance engine

-

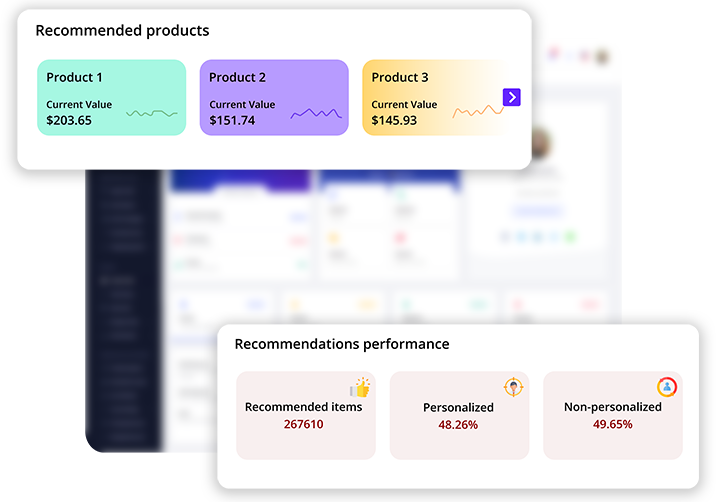

Adaptive product recommendation system

-

Proactive risk assessment toolkit

-

Integrated fintech platform

-

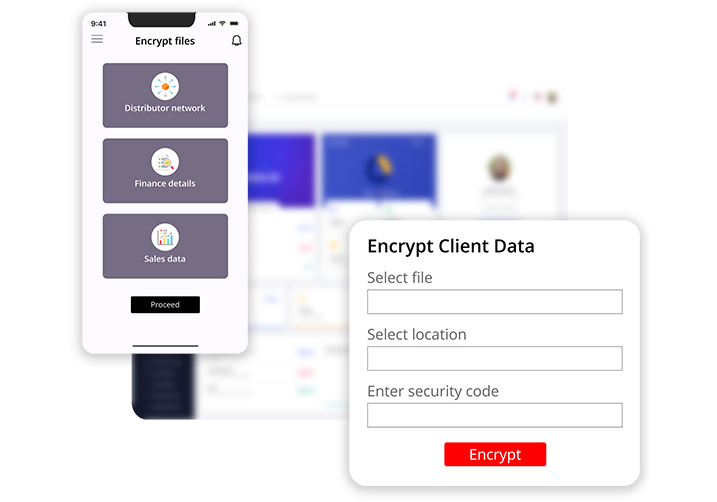

End-to-end encryption framework

-

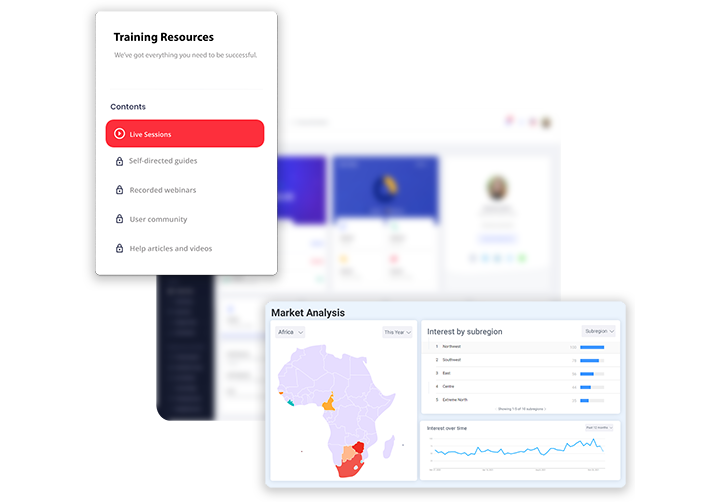

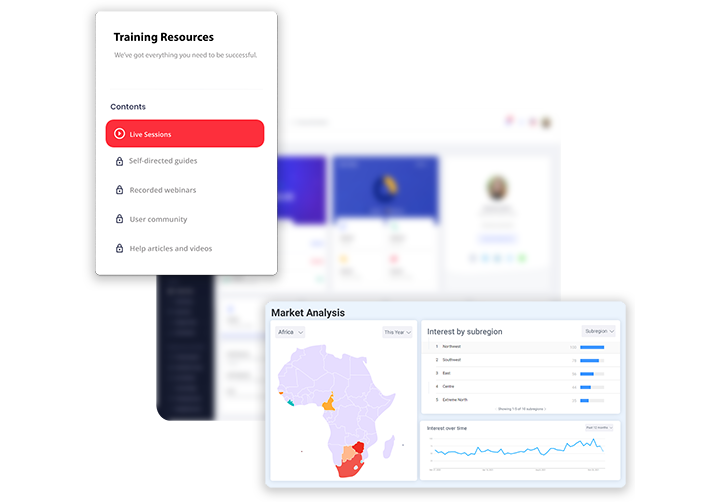

Market analysis and education hub

A real-time compliance monitoring and alert system that not only tracks regulations but also suggests actionable insights for maintaining compliance across different jurisdictions.

An AI-driven feature that matches client profiles with the most suitable financial products and customizes offerings based on changing client circumstances and market conditions.

Advanced analytics tools that utilize real-time data to forecast risks and provide preemptive recommendations, thus enabling better risk management strategies.

A comprehensive platform that facilitates the adoption of blockchain, AI, and other fintech innovations, ensuring seamless integration with traditional financial services.

A robust security architecture that ensures all client data is encrypted at rest and in transit, providing a fortress-like defense against data breaches.

A resource center that combines market analysis tools with educational content, helping both clients and advisors stay ahead of market trends and financial concepts.

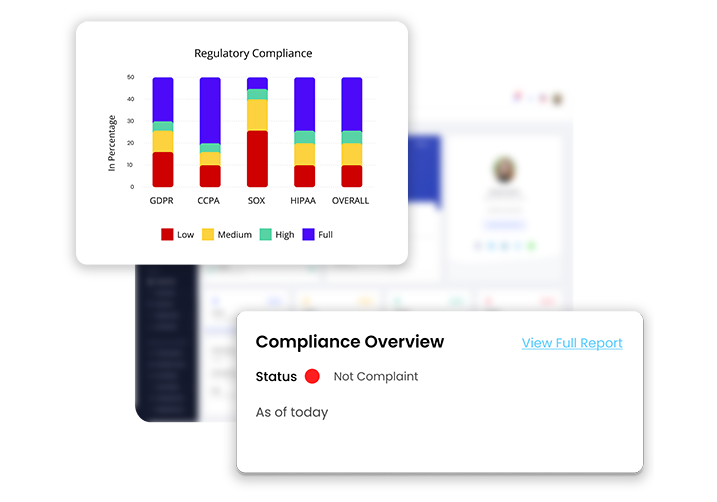

Dynamic compliance engine

A real-time compliance monitoring and alert system that not only tracks regulations but also suggests actionable insights for maintaining compliance across different jurisdictions.

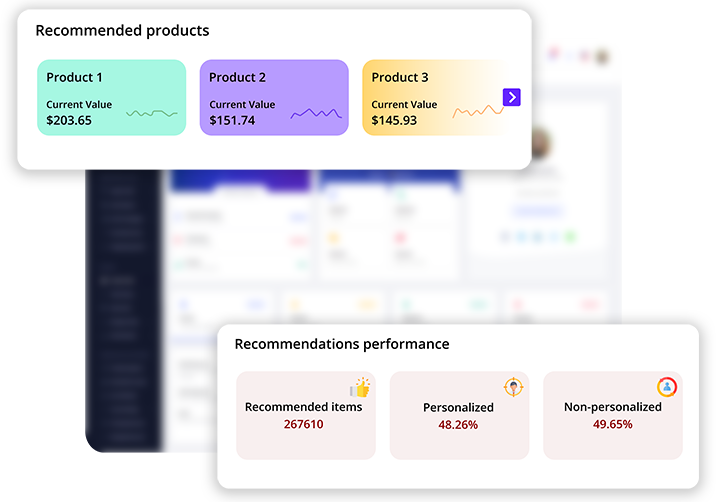

Adaptive product recommendation system

An AI-driven feature that matches client profiles with the most suitable financial products and customizes offerings based on changing client circumstances and market conditions.

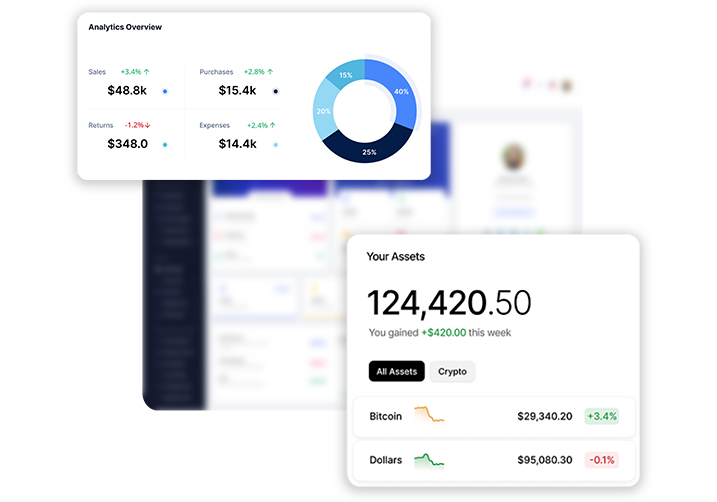

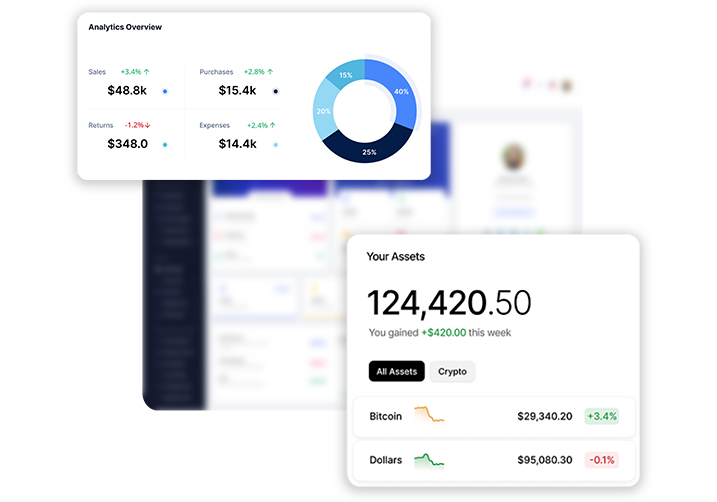

Proactive risk assessment toolkit

Advanced analytics tools that utilize real-time data to forecast risks and provide preemptive recommendations, thus enabling better risk management strategies.

Integrated fintech platform

A comprehensive platform that facilitates the adoption of blockchain, AI, and other fintech innovations, ensuring seamless integration with traditional financial services.

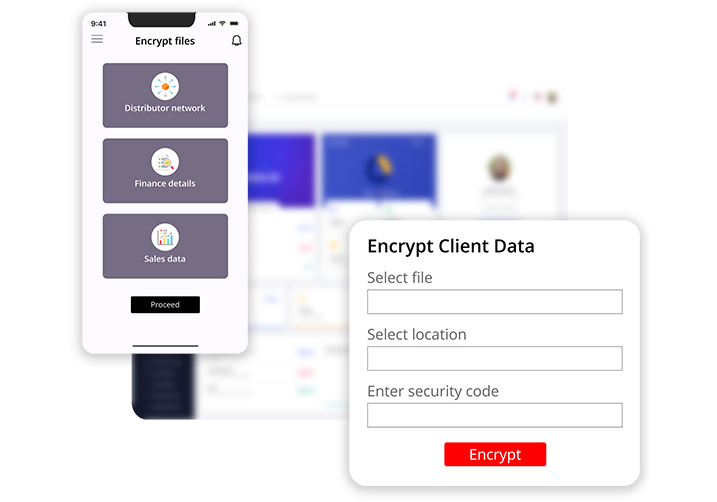

End-to-end encryption framework

A robust security architecture that ensures all client data is encrypted at rest and in transit, providing a fortress-like defense against data breaches.

Market analysis and education hub

A resource center that combines market analysis tools with educational content, helping both clients and advisors stay ahead of market trends and financial concepts.

Experience the future of financial management with the future-ready MLM platform designed exclusively for the financial services industry

Free DemoSophisticated use cases for MLM financial services software

Global compliance adherence

When a new financial directive comes into effect, the dynamic compliance engine automatically updates advisory practices across the network, ensuring that advisors are briefed and compliant, thus avoiding potential fines.

Customized financial planning

The adaptive product recommendation system analyses a young entrepreneur's profile and suggests a mix of growth-oriented and risk-mitigated financial instruments, aligned with their long-term business goals.

Anticipating credit risks

Before approving a substantial loan within the network, the proactive risk assessment toolkit identifies potential default risks based on economic indicators and client financial health, thus preventing a bad debt situation.

Fintech evolution

A legacy bank integrates cryptocurrency transactions into its service offerings using the integrated fintech platform, attracting a new segment of tech-savvy clients without disrupting its core operations.

Data security during client lifecycle

From onboarding to account closure, the end-to-end encryption framework ensures that every piece of client information is secured, giving clients peace of mind and reinforcing the network's reputation for data integrity.

Informed investment decisions

An investor utilizes the market analysis and education hub to understand the implications of a recent geopolitical event on their portfolio and decides to rebalance their assets accordingly, with the help of their advisor.

Redefine the future of your MLM financial services business with Epixel MLM platform

Free DemoReviews of Epixel MLM Platform for Financial Services

4.6/5 121 Google reviews

We were skeptical to outsource our software after a previous bad experience with another company, but Epixel has been incredible and we are very glad to have chosen them. They met all of our project requests and exceeded our expectations.